⚠It’s all over. The end is beginning. The markets will crash. Stocks will.🔻🔻🔻📉

Wait, I forgot to say hi.

Hi,

Thanks for reading this edition of the Tipsheet. It’s over. Stonks will go to ZERO, Nifty 50 will become Nifty 0, and you are going to the poor house.

This post will break in your Inbox. Open it in your browser or save it to Pocket or Instapaper and read it. I have a juicy edition this week 😋

The year is 1821, and George IV ascends the throne of Great Britain. Gregor MacGregor, the Cazique (prince) of Poyais, comes to London for the coronation. Poyais is the size of wales of the Mosquito Coast in the Gulf of Honduras.

MacGregor has grand plans for Poyais and needs money to make those plans a reality. He wants to develop Poyais into a utopia. He starts selling land certificates for two shillings and three pence per acre, and there’s incredible demand for the certificates. After all, MacGregor had sold Poyais as a paradise straight out of a fantasy novel. People bought the pitch, and everybody wanted a piece of it.

The way MacGregor described it, the soil of Poyais was so fertile that farmers could have multiple harvests in a year. There were lush forests ripe to be turned into timber. The rivers were filled with fish—you could catch a week’s worth of fish in a day—and globules of gold. The land was adorned with magnificent opera houses, government buildings, bridges and sea-facing mansions. Gregor MacGregor needed new settlers for this paradise.

Given the demand for the land certificates, MacGregor increased the price to four shillings—a few founds in today’s value. Hundreds of people were now proud owners of land in the kingdom of Poyais. He also sold £200,000 worth of 6% bonds backed by the revenues of the Government of Poyais.

By then, Thomas Strangeways, Captain in the Poyer army and Aide-de-Camp to his highness, Gregor MacGregor, had written a masterful 350-page book with a map of Mosquito Shore to be used by future settlers and emigrants.

MacGregor had promised that Poyais would be heaven on Earth. He even promised free passage to skilled craftsmen, artisans and tradespeople. In 1822, the Honduras Packet with 50-70 people on board sailed to Poyais. A second ship, the Kennersly Castle with about 200 people, set sail soon after. These people had cleaned out their savings, sold all their belongings and business to settle down in Poyais. Before departure, the future citizens of Poyais even exchanged English currency for notes from the Bank of Poyais.

The Honduras Packet, with people dreaming of a new life in a rich and bountiful land, reaches Poyais, but there’s a problem. Unlike what Gregor MacGregor described, Poyais was a desolate and barren stretch of land. There was nothing here; they were all scammed. Over the new few months, several people died of disease and starvation.

Gregor MacGregor had invented a fictional country and scammed thousands of people. The word of the scam quickly spread around London as the last remaining survivors from the two ships returned from Poyais—there was widespread outrage.

MacGregor quickly leaves London for France. Once in France, he didn’t give up, he ran the same scam again. This time, he raised £300,000 backed by the gold mines of Poyais and people bought that too. After being arrested and acquitted in France, he moved back to London and again partly sold £800,000 worth of bonds running the exact same scam.

The total value of his fraud would be worth over £3.6 billion today. This was way back in the 1820-30s. What a visionary!

What makes this scam special is the level of attention to detail. Gregor MacGregor had designed a flag. He had also designed army dresses, created various titles and ranks, and even had songs and balls composed about Poyais. Remember that book by Thomas Strangeways? There was no Thomas Strangeways. He made him up. He wrote that 350-page book under a fake name—this was content marketing before content marketing.

According to most accounts, the 1800s were the golden age for fraud. But compared to today, the 1800s look like a joke. We are living through the most scammy and fraudulent period in the history of humanity.

Fraud and scams are rampant all across society. The legendary hedge fund manager, Jim Chanos, aptly calls this period “ the golden age of fraud.” I agree because I write about scams here!

Today, he says, “we are in the golden age of fraud”. Chanos describes the current environment as “a really fertile field for people to play fast and loose with the truth, and for corporate wrongdoers to get away with it for a long time”. He reels off why: a 10-year bull market driven by central bank intervention; a level of retail participation in the markets reminiscent of the end of the dotcom boom; Trumpian “post-truth in politics, where my facts are your fake news”; and Silicon Valley’s “fake it until you make it” culture, which is compounded by Fomo — the fear of missing out. All of this is exacerbated by lax oversight. Financial regulators and law enforcement, he says, “are the financial archaeologists — they will tell you after the company has collapsed what the problem was.” - FT

It’s just stunning how easy it is to run scams and defraud people. Anybody, and I MEAN ANYBODY with an IQ of 10 can make some serious money running scams. You have to be the dumbest idiot on the planet to get caught in this environment.

Land of the free and home of the decentralized brave

Let’s start with crypto because it’s a giant scam, and it’s going to save humanity from the tyranny of the central banks who are debasing money and us! What that fuck, you might be wondering. How can it be a scam and save humanity at the same time? You might be wondering further. As Scott Fitzgerald famously said:

The test of a first-rate intelligence is the ability to hold two opposing ideas in mind at the same time and still retain the ability to function. One should, for example, be able to see that things are hopeless yet be determined to make them otherwise.

Crypto is truly the wild west for grifters. It’s helping the world economy and increasing GDP by providing full-time employment to a host of shady characters with impressive experience in grifts, cons and scams. It’s unregulated, mostly anonymous, mostly decentralized. To top it all, the old people who call themselves “lawmakers”, “regulators” are clueless about how to deal with crypto.

In short, It’s the perfect recipe for doing all the shady shit you’ve wanted to do since you were a kid and said, “I want to be a scamster” when your teacher asked what do you want to be when you grow up.

Pump and dumps

We’ve got “influencers” like Kim Kardashian and Floyd Mayweather pumping random shitcoins for a buck. But karma can be a bitch. They were sued earlier this month.

Then there were the people from an influencer group called Faze clan who pumped and dumped a token called $KIDS. The people associated with the token claimed to donate money to causes related to children.

They didn’t stop with $KIDS. The group was involved with other scammy coins. Idiots with a few thousand followers on YouTube are busy shilling all sorts of random scammy tokens, and they’re making money too. It’s really the wild, wild west. Thanks to the internet, there’s an endless supply of gullible idiots to buy everything from Asscoins to Omicron.

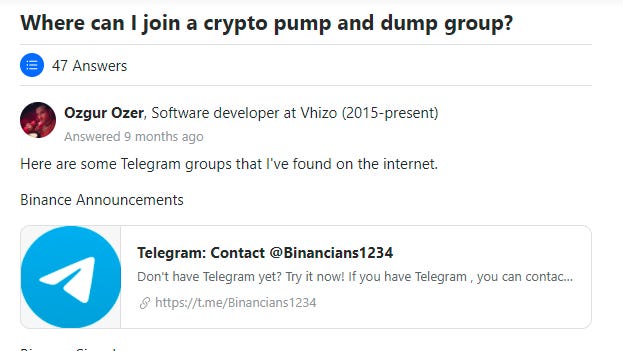

It’s not just the influencers that are pumping and dumping. No! Pumping and dumping has truly been democratized. Any honest, law-abiding citizen can run or be a part of a pump and dump scheme and make money. There are thousands of Reddit, Telegram and WhatsApp groups dedicated to pumping and dumping shitty tokens.

A sign of the times 😭

These people aren’t hiding or dishonest either. They actually name the groups as “pump and dump” and express their intentions clearly, displaying admirable honestly. The crypto warriors don't hide like people who pump and dump stocks.

Here’s a message from one such crypto pump and dump Telegram group that The Australian Securities and Investments Commission (ASIC) recently infiltrated:

With an average trading volume of 40 to 80 million US dollars per pump and a peak value of 450%, we are ready to announce our next big pump,” said a statement from the group on September 13th. “Our main goal for this pump is to make sure that all team members make big profits. We will also try to achieve a trading volume of over 100 million US dollars in the first few minutes, with a very high percentage increase.

Here’s what Anirudh Dhawan and Tālis J. Putniņš of University of Technology Sydney (UTS) found looking at pump and dumps:

Like pump-and-dump manipulation of stocks, cryptocurrency pumps generate large price distortions (average price movements around 65%), generate abnormal trading volumes (13.5 times the average volume), and earn the manipulators millions of dollars. Similar to stock manipulation, manipulators target fairly illiquid coins, although they avoid coins with so little liquidity that manipulation would be infeasible or not sufficiently profitable.

However, in contrast to pump-and-dump manipulation in stock markets, cryptocurrency pump-and-dumps do not rely on information asymmetry and uncertainty about the value of the manipulated security—manipulators openly declare their intentions to manipulate.

Cheerleaders

Then you have the cheerleaders without skirts like Michael Saylor, Anthony Pompliano, and Dave Portnoy among others.

Just watch this masterpiece. Please don’t scroll down. Please watch this 👇

Not a pump and dump. Not a cult.

And then you have this idiot:

These people with millions of followers constantly talk and tweet about Bitcoin to induce people to buy. Bitcoin could be a Ponzi or not—I don’t know. But it’s a pump and dump for sure.

VCs and the Jesus complex

Like I had written a while back, VCs are hellbent on saving the world, and this includes crypto as well. For all the talk about decentralization, a lot of crypto projects are really controlled by insiders and VCs, like a normal startup. The VCs are leveraging this whole crypto freedom propaganda to engage in self-dealing and are making some serious money👇

Noxious fungible turds (NFTs) and wash trading

And just when I was writing this, I give you the President and a Director of BlackRock, the world’s largest asset manager with over $10 trillion in assets 👏

Non-fungible tokens (NFTs are ugly pictures of rocks and monkeys. Apparently, they are “art” and sell for millions. The claim is that they are removing the gatekeepers and democratizing the ability for artists to make money. But the reality is different, NFTs are highly concentrated.

Top 10% of traders alone perform 85% of all transactions and trade at least once 97% of all assets.

Top 10% of buyer–seller pairs contributing to the total number of transactions as much as the remaining 90%

If you look closely, wash trading is rampant in NFTs.

A wash trade is a form of market manipulation in which an investor simultaneously sells and buys the same financial instruments to create misleading, artificial activity in the marketplace.[1] First, an investor will place a sell order, then place a buy order to buy from themself, or vice versa.

The most egregious example of wash trading was a recent sale of CryptoPunk 9998. The same person bought and sold for $500 million and relisted for sale for about a billion. NFTs are perfect for wash trading because they aren’t as liquid as crypto tokens since they are unique one-off items.

Wash trading works best when the market is thin. If your above-fair-price wash trades run into real orders from other traders, you’ll lose money! You want to maximize the likelihood that you actually sell to yourself.

An aside on NFTs Because they’re “unique” objects, NFTs are a perfect vehicle for wash trading. You can easily ensure you only wash trade to yourself. The common scheme is to wash trade with yourself until some credible dunce buys the NFT from you at your manufactured “fair” value, leaving you to walk away with real money.

Not just NFTs, wash trading is rampant across all the other crypto exchanges. Estimates are between 30% to 70% of all volumes across popular exchanges are wash trading.

Old school

Sometimes the best way to scam people is through the tried and tested ways. In this case, multi-level marketing (MLM) scams and a daily returns scam combined. A few weeks ago, The Enforcement Directorate (ED) uncovered a Rs 1200 crore scam.

These people were promising people a daily return of 3-5% according to reports. The money would be invested in Morris Coin, and here’s what it does👇😂

Lakhs of people apparently invested money in this. The scamsters, in turn, invested the money in real estate and also has signed up to produce a Malayalam movie.

Not just this, there are plenty of other such crypto scams. I came across this new shitcoin called Bigh Bull that was running full-page ads in regional dailies.

Easiest scam ever

Just using the word “crypto” has become one of the easiest ways to run scams.

Indians visited crypto scam websites more than 17.8 million times in 2020. The figure fell sharply in 2021, but it was still substantial at 9.6 million times. - Mint

Parting thoughts

Yeah, yeah, don’t get your underwear in a knot, shut up! I’m not saying all crypto and NFTs are a scam—I’m hedging😂 But 100% of all these stupid dog tokens and shitcoins are going to zero. People will keep launching, pumping and dumping them as long as there are idiots willing to buy them. Once the party ends in 2073, Dogecoin, Asscoin and —Insert name—coins will go to zero. This crash is just 51 years away.

As for the actual OG crypto tokens like Bitcoin, Ethereum and DeFi, I hate to break it to you, but they won’t be able to deliver freedom from Afghanistan to Panvel. I’m sorry, I just don’t see that happening. They’ll have a much more boring reality. On a serious note, once all this madness ends, the stupidity washes away, and old people figure out how to regulate crypto, we’ll probably see the real crypto ecosystem emerge.

Corporate governance

In 1970, Eugene Fama published a paper saying the markets are efficient. He basically said that stock prices reflect all available information, and it’s almost impossible to beat the market. In 2013, he was awarded the Nobel Prize for the efficient market hypothesis (EMH) and other contributions.

Fast forward to 2020, a sexy virus called COVID-19 hits the world with a murderous rage only seen previously in the movie Final Destination. The entire world gets scared and goes into lockdown. Governments worldwide started giving free money to anybody above the age of 17. Millions of bored teenagers were stuck at home with money they couldn’t spend outside.

At that moment, all these teenagers suddenly discover the stock market. They all come together on platforms like Twitter and Reddit to become financially literate. As they were getting their financial literacy on, they discover that the evil and grubby hedge funds are shorting companies like AMC and GameStop and are rooting for them to fail.

The teenagers didn’t like this one bit. They declare a financial jihad on all the evil hedge funds. In a stunning display of cooperation, all the teenagers decided to work together. They form tribes on the interweb and call themselves apes, lizards and cockroaches. After all, humans are tribal beings.

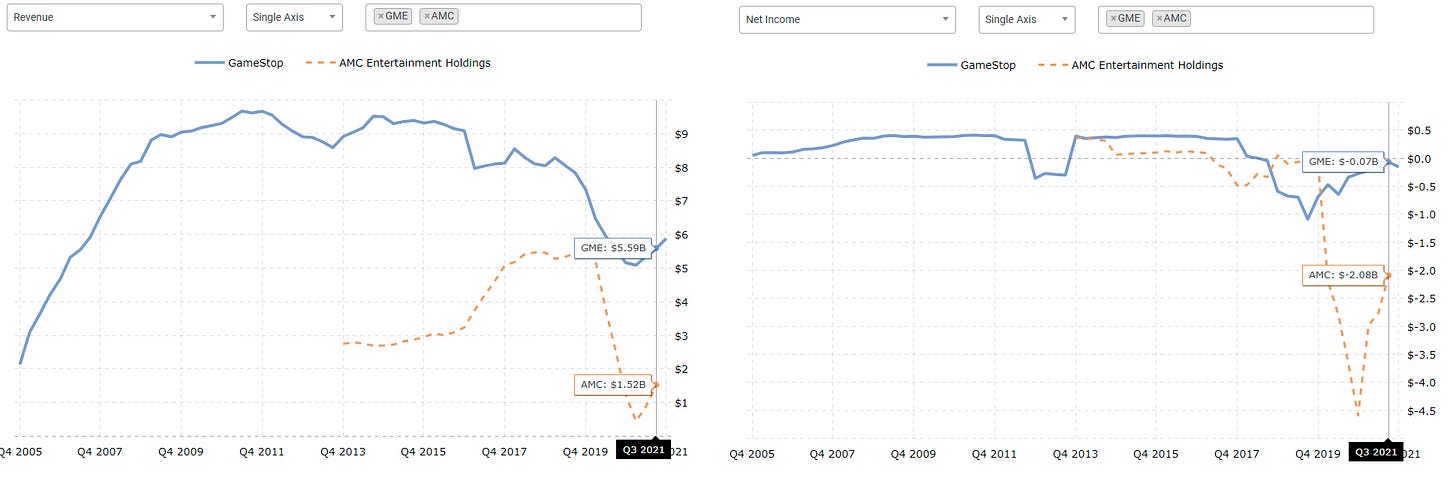

The teenagers stuck in their moms’ basements start buying the stonks the evil hedge funds were short against. The evil hedge funds were short against stonks like AMC and GameStop because they were dying businesses:

But the teenagers who just had their first acne breakout didn’t care. They didn’t believe in propaganda like fundamentals and profitability. They went to war with the hedge funds and pumped up the prices of stonks like AMC and GameStop and start moving the prices up.

Several hedge funds had their shorts blown out and gave up. They started the meme stock revolution, much like the French Revolution and the American revolutions but with unprofitable dying stonks.

The teenagers prove that Fama’s EMH is bullshit.

The virus was raging. With everything locked down, movie theaters were shut. AMC Entertainment, the largest movie theater chain in the US, is on the verge of bankruptcy.

But suddenly, the teenagers with bad breath, acne and ill-fitted braces look at the financials of AMC and see that the company is losing money, has an insane amount of debt and is about to go out of business—they like how fundamentally strong the company is. They instantly embrace AMC as the next offline Netflix. The teenagers even come with a name— the Ape Army, and they end up owning 80% of the company.

The CEO Adam Aron embraces the Ape Army like his own children, wears lipstick, and starts kissing their asses. To make them happy, he starts offering them free popcorn, announces that AMC would accept crypto payments, including Doge & Shiba, donates money to a Gorilla charity and even offers free “I Own AMC” NFTs.

As he is kissing teenage ass, he’s raising massive amounts of debt and issuing as many shares as he possibly can. The pace at which Adam was selling new shares was only matched by the Federal Reserve's pace of printing money.

Oh, and not to mention, the insider sin AMC were also dumping shares.

This was just one example of the ridiculousness we saw in the last 2 years. Who said good corporate governance is important. Absolute nonsense!

Blow Trump…ets

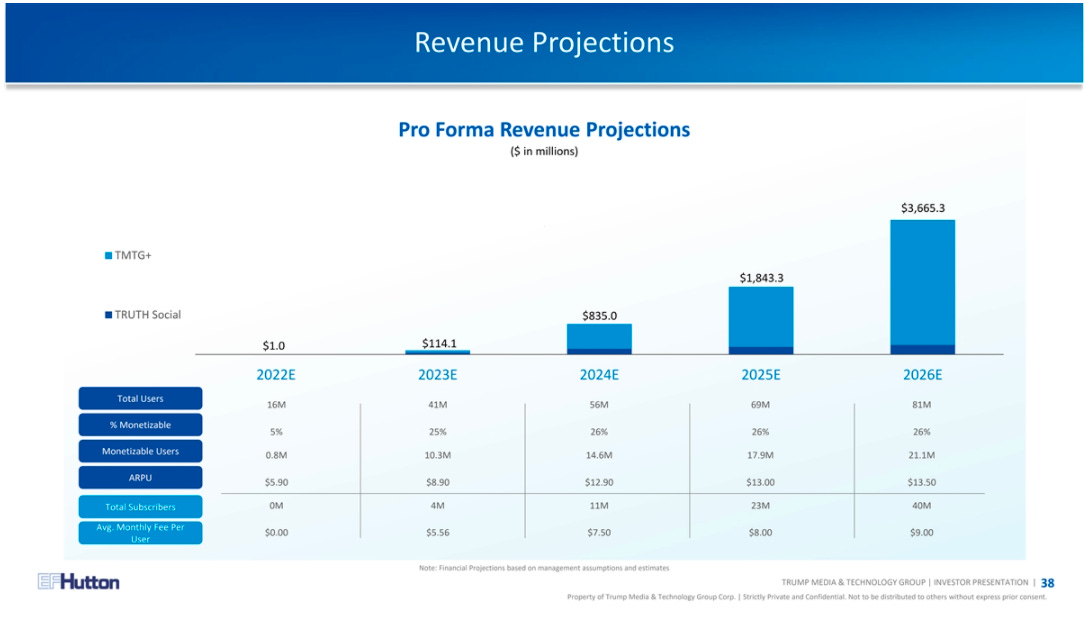

But my favourite scam of 2021 involved Donald Trump, of course. Donald Trump, AKA Mango Mussolini, wants to build a social network to take on Twitter—he’s calling it TRUTH! I had written about this earlier when the Trump Media & Technology Group announced that it would merge with Digital World Acquisition Corp (DWAC), a SPAC.

Donnie has yugee ambitions. He wants to compete with Facebook, Twitter, Netflix and eventually with AWS and Stripe. It’s already valued at around $3-4 billion.

Here are some projections.

Since the merger announcement, DWAC (SPAC) is up 190%+.

But there’s just one small problem. There’s no product yet. Like, nothing. Oh, and the deal is also under investigation by the SEC.

This is a pump and dump in its purest form. The value of the cash in $DWAC is just $10 dollars, and it’s trading at $60-70. You might say, well, that’s because Orange Mussolini’s company will be the new Twitter. But there’s another tiny problem. Donald Trump started a company with absolutely nothing to show for and is leveraging his brand and the meme stock mania to dump worthless stock on idiotic investors to make money.

It doesn't end there. The SPAC recently completed a $1 billion Private Investment in Public Equity (PIPE) deal where investors get shares at a discount. Typically, PIPEs have selling restrictions after a SPAC completes a merger. But in this case, nobody wanted to do business with Trump, so the company sweetened the deal by offering shares at a discount and allowing them to immediately sell the shares after the merger closes.

It’s amazing how brazen this scam is:

To underscore how little sense that makes, consider this: Trump’s entire real estate empire—which he has spent his life accumulating—is worth just $2.5 billion. Investors are currently treating his barely formed media business as if it’s worth more than four times as much as everything else the former president owns.

With no operating business, Digital World Acquisition is now little more than a pile of cash—and a diluted one, at that. In the best-case scenario for investors, no one will redeem their shares, allowing the SPAC to retain its cash in the merger. That would leave it with an estimated $280 million and 37.2 million shares outstanding after it combines with Trump’s company and pays the underwriters. Put it another way, the amount of cash per share would be just $7.62.

So even before the deal, PIPE investors are already in the safe zone. The retail investors will, in all likelihood will e left holding a bag.

Selling packaged crap (SPAC)

It’s not just Trump’s SPAC, most SPACs are downright frauds. The structure of the SPAC, in theory, is beneficial because it allows companies to bypass the lengthy traditional IPO process. But the reality is that it very rarely works.

When a SPAC is formed, it sells shares to the public, typically at $10 and raises money. At this point, a SPAC is just a blank check company with a pile of cash. It typically has 2 years to find a target to acquire, or else the SPAC dissolves, and cash is returned to the shareholders.

The promoter typically gets 20-25% of the shares for free because he’s doing all the hard work of forming the SPAC. So straight out of the gate, the $10 is diluted. Then there are mandatory expenses in the range of 6-12% of the money raised for the IPO & the merger. This is compared to the 6-8% cost incurred by traditional IPOs. Add the free shares and the high SPAC costs, they make a really shitty deal.

Michael Klausner and Emily Ruan of Stanford and Michael Ohlrogge of NYU looked at the rate of dilution in SPACs and the numbers are stunning!

The structural elements of SPACs that are the source of their dilution and incentive misalignment remain essentially unchanged. Those elements are as follows:

The essentially free shares a sponsor takes as its “promote”

The free warrants issued to IPO investors

An underwriting fee that does not adjust for redemptions

Other high fees incurred at the time of the merger

During our study period, from January 2019 through June 2020, the cost of these features of the SPAC structure was, on average, a whopping $5.90 and, at the median, $4.30 for each pre-merger SPAC share. Those are the amounts extracted by SPAC sponsors, IPO investors, underwriters, and other advisors to SPACs – leaving SPAC shareholders with net cash per share of $4.10 on average and $5.70 at the median.

A vast majority of the SPACs choose to merge with dubious and horrible companies, and the end result is that insiders like promoters and PIPEs make all the money. Retail SPAC investors end up underperforming an index fund. Here are some sobering numbers from analyses by Jay Ritter and Michael Cembalest

Market markets efficient again!

The funniest scam I came across in 2020 was the supposed insider trading by US senators. The highlight of this dumb charade was when Nancy Pelosi recently said lawmakers shouldn’t be barred from trading because the US was a free-market economy 😂. Just remember this statement and look at some of these numbers.

Last year, Congress bought and sold nearly $290 million in stocks (corresponding to 3,500+ transactions by 105 members of Congress), $140 million in options contracts (270+ transactions by 6 members), $124 million in other securities like private equity funds (200+ transactions by 19 members), and $500k in cryptocurrencies (25 transactions by 6 members).

Compared to 2020, the total amount of options trading exploded in 2021 by over 5x, meanwhile trading in other notable asset classes decreased.

The busiest traders in Congress this year were: House Representatives Josh Gottheimer, Marie Newman, Susie Lee and Zoe Lofgren. Gottheimer alone had 134 trades in the first quarter of 2021!

29 senators have violated trading laws in some brilliant ways. Guess what’s the fine for violating trading rules for senators? A $200 fine 😂

It might seem wrong that these people are using their position to trade on what might possibly be non-public information. When you put it like that, it does seem shady. But what are doing is social service. Markets are the most efficient when stock prices reflect all information.

If all these senators are trading on insider information, stocks will reflect information that wasn’t public, and the markets will become more efficient. If you think about it, they are insider trading day and night to make markets more efficient. Such selflessness! I wish Indian politicians learnt from the US politicians.

Just the tip…

These are just some egregious examples of scams par excellence that came to mind, and there are a hundred other examples. Thanks to the internet, the world has become a much smaller place. Aspiring and hardworking scamster can run scams on anyone, anywhere in the world. Fraud has been truly democratized.

Last year in India, there were over 200,000 tech support scams.

India has the highest increase in the number of people who lost money to tech support scams.

In the US, T-Mobile blocked over 21 billion scam calls in 2021. Truecaller estimates the damage from phone scams at nearly $30 billion. A staggering number, even if you take it with 3.7 buckets of salt.

Social media scams, elderly fraud, romance scams, Bank frauds, it's peak fraud in everything.

Good reads

Does the Endowment Model Measure Up? – A Conversation with Richard Ennis

What happens when the world’s most populous country starts to shrink

Andy Warhol, Clay Christensen, and Vitalik Buterin walk into a bar

Playlist

A few podcasts on my playlist

I laughed and cried after reading this. Thanks!

Top notch, sir! Made scams intelligible to dummies like me!