Hi, blah blah, blah, intro, blah, blah, blah.

Now go read the post, I’ve spent a lot of time writing it, I’ve risked my life writing it. You’re welcome.

This post might break in your email, if it does, get a new bloody fone. If you’re too poor to, here’s the link to read it in your browser or your Pocket or Instapaper. Damn poor people! Couldn’t you people have bought some Shiba Inu coin or Spankcoin?

In a previous issue, I wrote about how traditional news media is in trouble and all the stupid shit it’s trying to survive. One of the biggest casualties of traditional media’s troubles has been investigative journalism. Old school shoe–leather and muckraking journalists are increasingly becoming a rarity today. There are more seriously undervalued unicorns than investigative reporters.

Being the son of a journalist, I’ve always had investigative journalism in my DNA. Today, I’m proud to showcase some serious investigating I have done this year.

It’s February 21st, and it’s a chilly day in Indore. The biggest names from the world of crypto have gathered in WOW hotel to discuss the industry’s future. I asked one of the biggest crypto whales why they chose to meet up in Indore. He answered that they didn’t want the prying eyes of the US media. When I asked him if he knew that Indore was the home of all the stock tipsters and assorted scamsters in India? He was taken aback and said that it was purely coincidental.

Well, despite the unfortunate choice of location and all the insinuations that it bought along, the mood was one of happiness among all the crypto bros and crypto broesses (ladybros?). At the ripe age of 78, Joe Biden had created a fairytale by becoming the first escapee from an old-age retirement home to become the president of the United States.

In Feb 2021, despite being old, he had chosen Gary Gensler to head The U.S. Securities and Exchange Commission (SEC) (US SEBI). Gary was the former head of the Commodity Futures Trading Commission (CFTC) under my man Barack’s presidency, and he had also worked in the US Treasury. More importantly, he used to teach a course on Blockchain at MIT Sloan School.

The total marketcap of crypto had hit $1.6 trillion on 21st Feb, and all the crypto bros and broesses were happy. They were now even happier, given that one of their own would be heading the SEC. The expectation was that since Gary understood blockchain, as soon he was sworn in as the head of the SEC, he would create a Twitter account with lazer eyes and start passing crypto-friendly regulations and also approve crypto Buttcoin, sorry Bitcoin ETFs.

But the joy didn’t last long. Immediately after Gary was sworn in, he started making “anti-crypto” noises.

In May, this is what Gary said at a FINRA conference:

So, if you’re asking a lawyer, accountant, or adviser if something is over the line, maybe it is time to step back from the line. Remember that going right up to the edge of a rule or searching for some ambiguity in the text or a footnote may not be consistent with the law and its purpose.

There’s an old saying: “When I see a bird that walks like a duck and swims like a duck and quacks like a duck, I call that bird a duck.”

What’s more, technology is always evolving, as are our markets. As we continue to stay abreast of those developments, the SEC and FINRA should be ready to bring cases involving issues such as crypto, cyber, and fintech.

In a testimony before the Subcommittee on Financial Services in May:

Many of these tokens are investment contracts under the securities law. Over the years, the SEC has brought 75 cases in this area.[11] The SEC has been consistent in its communication to market participants that those who use initial coin offerings to raise capital or to engage in securities transactions must comply with the federal securities laws. Asset managers that invest in these assets may come under securities laws, too.

There are many challenges and gaps for investor protection in these markets. Tokens currently on the market that are securities may be offered, sold, and traded in non-compliance with the federal securities laws. Furthermore, none of the exchanges trading crypto tokens has registered yet as an exchange with the SEC. Altogether, this has led to substantially less investor protection than in our traditional securities markets, and to correspondingly greater opportunities for fraud and manipulation. The Commission has prioritized token-related cases involving fraud or other significant harm to investors

In response to a July letter from Elizabeth Warren, here’s what Gary responded:

A typical trading platform has more than 50 tokens on it. In fact, many have well in excess of 100 tokens. While each token’s legal status depends on its own facts and circumstances, the probability is quite remote that, with 50 or 100 tokens, any given platform has zero securities. I believe we have a crypto market now where many tokens may be unregistered securities, without required disclosures or market oversight.

To the extent that there are securities on these trading platforms, under our laws they have to register with the Commission unless they meet an exemption. If a lending platform is offering securities, it also falls into SEC jurisdiction.

To the extent that there are securities on these trading platforms, under our laws they have to register with the Commission unless they meet an exemption. If a lending platform is offering securities, it also falls into SEC jurisdiction.

In August, here’s what Gary said at the Aspen Security Forum:

Right now, we just don’t have enough investor protection in crypto. Frankly, at this time, it’s more like the Wild West.

This asset class is rife with fraud, scams, and abuse in certain applications. There’s a great deal of hype and spin about how crypto assets work. In many cases, investors aren’t able to get rigorous, balanced, and complete information.

The Buttcoin, sorry Bitcoin bros and broesses, were heartbroken at this dhoka. They hoped that blockchain Gary would go easy and take a lighter approach to regulate them, but Gary turned out to be just another suit.

Things came to a head when Brian Armstrong — no relation to Neil Armstrong though Brian is in the business of taking Dogecoin to the moon, tweeted that the SEC was being sketchy. Now, if you’ve had any experience in the financial services industry, the one thing you don’t do is pick a fight with the regulators. It’s like if you’re surrounded by 5 people who want to kill you, the last thing you want to do is dare them to kill you. I mean, in some twisted reverse psychology way, it might work, but do you want to take that chance?

Here’s the backstory. Coinbase wanted to launch a product called Lend. That way it works is you deposit select crypto tokens, and you get a 4% yield. They initially wanted to start with USD Coin (USDC), a stable coin backed by actual dollars, treasuries and commercial papers. So, according to Coinbase, they were ready to go live, and they sent a WhatsApp message to SEC as a “friendly heads up and briefing”. I did some investigative journlisming and here’s the WhatsApp conversation:

Coinbase: Hi

SEC: New fone, who dis?

Coinbase: Coinbase

SEC: Coinbase who?

Coinbase: Hint: We’re going to the moon!

SEC: Oh!

Coinbase: What that “Oh!” mean?

SEC: Nothing, what you want?

Coinbase: We launching new product called lend. People deposit crypto. We give them 4% interest—just a heads-up. We ain’t really asking for permission, but whatever, we letting you know. Bye!

SEC: Yeah, no! You can’t launch! You have to register with us!

Coinbase: Why?

SEC: It’s a security.

Coinbase: No, it’s not.

SEC: Yes, it is!

Coinbase: Explain how?

SEC: When I see a bird that walks like a duck and swims like a duck and quacks like a duck, I call that bird a duck.

Coinbase: You’re wrong, and we’re going to launch it.

SEC: We’re gonna sue your decentralised ass!

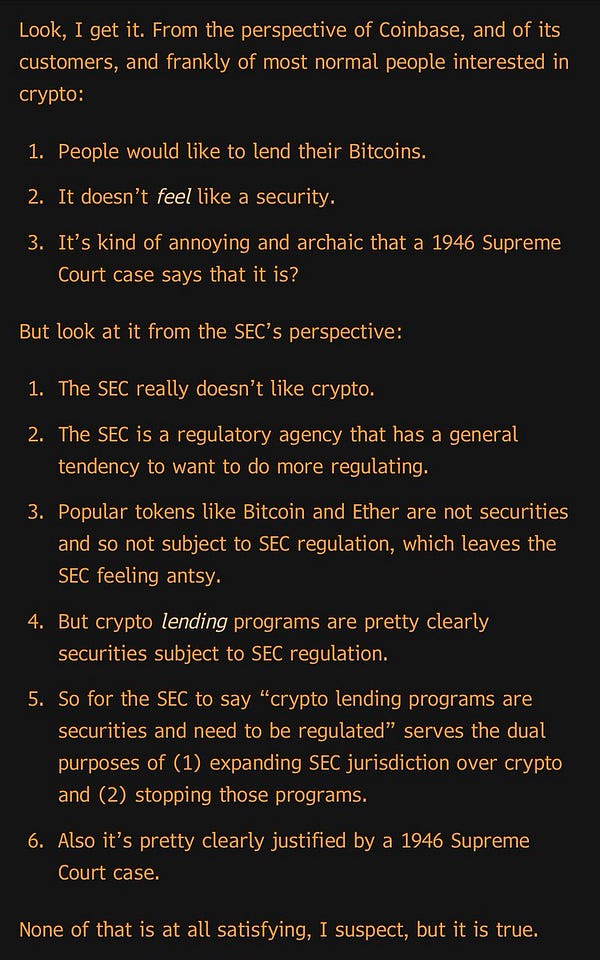

Now look, here’s the thing, the SEC says, it looks like a security, it talks like a security, then it is a security. Coinbase is like, no! But this brouhaha doesn’t end there. The legal head of Coinbase decided to write a perplexing post:

Despite Coinbase keeping Lend off the market and providing detailed information, the SEC still won’t explain why they see a problem. Rather they have now told us that if we launch Lend they intend to sue. Yet again, we asked if the SEC would share their reasoning with us, and yet again they refused. They have only told us that they are assessing our Lend product through the prism of decades-old Supreme Court cases called Howey and Reves. The SEC won’t share the assessment itself, only the fact that they have done it. These two cases are from 1946 and 1990. Formal guidance from the SEC about how they intend to apply Howey and Reves tests to products like Lend would be a big help to regulating our industry in a responsible way. Instead, last week’s Wells noticetells us that the SEC would rather skip those basic regulatory steps and go right to litigation. They’ve offered us the chance to submit a written defense of Lend, but that would be futile when we don’t know the reasons behind the SEC’s concerns.

The SEC has repeatedly asked our industry to “talk to us, come in.” We did that here. But today all we know is that we can either keep Lend off the market indefinitely without knowing why or we can be sued. A healthy regulatory relationship should never leave the industry in that kind of bind without explanation. Dialogue is at the heart of good regulation.

This Howey test thing comes from a 1946 case in which the US supreme court defined some rules to figure out if something is an investment contract or not:

An investment of money

In a common enterprise

With the expectation of profit

To be derived from the efforts of others

Now, Coinbase takes money, pools money to generate a profit in a common enterprise. It clearly is an investment contract. You lend money, get interest. What could this possibly be? Errr… a bond?

You know you’re in trouble when a securities regulator decides to troll you with an explanation of how a bond works on the same day you call them sketchy for telling you that a product where you lend money and receive interest is not a security.

But Coinbase, being the libertarian torchbearer for delivering economic freedom for all the fiat oppressed masses from Kashmir to Timbuktu, doesn’t think so! This is because this would bring them into the orbit of the SEC. So far, apart from being regulated as a listed company by SEC, none of the products they offer are regulated by the SEC.

For a financial institution with a market value of more than $50 billion, Coinbase is so far remarkably free of regulation. The cryptocurrencies that trade on the exchange haven’t been classified as securities, which the SEC oversees, or as derivatives, which the Commodity Futures Trading Commission oversees. As a result, it doesn’t face the requirements for safety, soundness and investor protection that the regulators impose on exchanges under their purview.

On the other hand, the SEC thinks crypto is full of scams, and they don’t want to look useless. They want to regulate crypto badly. It’s ijjat ka question. The SEC will tell you they want to protect investors and all that nonsense but make no mistake, this is a dick-measuring contest, and Coinbase thinks it has a bigger dick than the SEC.

Matt Levine sums it up succinctly!

So, finally, the SEC sent Coinbase a Wells Notice. It’s basically a heads-up saying that the SEC intends to sue Coinbase’s decentralised libertarian ass, and they have one final chance to come in and explain things. You know, there are certain moments that decide the course of the rest of your life. When we’re in such situations, the best thing to do is to take a step back, listen to Sadhguru, take a deep breath, think hard and then make a decision.

This was one such moment for Coinbase. Instead of thinking hard about its next move, Coinbase decided to do the exact opposite. Brian decided to wear a YOLO T-shirt and throw petrol on the fire. He opened his Twitter app and tweeted a long thread, and started with calling the SEC sketchy:

It looks like Coinbase is trying to pressure the SEC by trying to influence public opinion. The logic was – there are a lot of investors in crypto, and what if we paint ourselves as a victim of the machine? What if we play the sympathy card and get all lazer eyes to abuse the SEC?

I mean, sure, it’s a nice strategy if you’re fighting with your neighbour because his dog shat on your lawn. But this is the SEC. It’s like you murder someone, get caught, and you decide to play the sympathy card that you murdered that person because you wanted to save the planet. Since you killed him, that person won’t be farting and emitting greenhouse gasses, and ipso facto, you’re solving climate change.

Here’s another angle to this saga:

Here’s what I think might be going on here. The SEC is likely pretty upset with Coinbase for its misrepresentation to investors that the stablecoin USDC was fully backed by US dollars sitting in a bank, even after Circle admitted it wasn’t. Coinbase kept this proclamation on its website for weeks after Circle came clean. Simply put, this isn’t something public companies should be doing, and it likely gave Gensler the opening he needed to make an example out of Coinbase. It is important to note that Coinbase is a partner to Circle and helped bring USDC to market. Here’s how they announced it in 2018:

But the best part to me in all this is that Brian going to the moon Armstrong kept harping that they asked the SEC to be clear, but they didn’t. Hmmm, it seems like a reasonable request, doesn’t it?

But let’s say you killed someone with a knife, get arrested, and you’re taken to jail. Now, let’s say you start screaming at the cops as to why you were arrested. Would you expect the cops to explain that killing someone is wrong?

This shit is supposed to be obvious!

I was thinking about this, and Ben McCormack perhaps had the best explanation of all:

The SEC says “we’re going to sue you” and Coinbase says “please can you be our lawyer and tell us why?”. Come on.

If you view the SEC as a customer care center, you’d be frustrated with their lack of transparency. But they’re not a customer care center; they’re a regulatory agency. When they say they’re going to sue you, you can assume their lawyers have taken a look at the same body of law as your lawyers, and their lawyers think a judge will agree with their perspective in the case of a disagreement—in this case, whether the crypto lending product is a security—and therefore it may be worth suing you if you don’t see things their way. And by the way, they’re not your lawyers, so they’re not going to advise you on the body of law that your lawyers should be advising you on.

Which is why I’m puzzled. Why are Coinbase’s CEO and CLO acting surprised that the SEC isn’t offering more details about their potential lawsuit? Surely it’s obvious they can’t be seen as giving Coinbase legal advice when they’ve made it clear they intend to sue them?

Regulatory woe…unto you

The way I think about it, there are two sides to the problem of regulating crypto. On the one hand, most of the crypto crowd takes the “oh, they don’t understand crypto” position.

It’s true to some extent. Crypto has the misfortune of dealing with 70-year-old politicians and regulators who still don’t understand how to find the # symbol in a smartphone. But by taking that position, they aren’t doing anyone any favours. Adding to this all this Bitcoin and Ethereum will save the world and create a borderless world maximalist bullshit is taking the conversation away from reality.

On the other hand, defining crypto itself is a mega challenge – security or a currency? Because crypto obviously had implications on financial stability, most notably stablecoins. Brilliant folks like Rohan Grey recognise this, and they’ve even pushed for regulations that would require stablecoins to get a banking charter, for example.

Then there’s the obvious issue of “who has the biggest dick in the room”. Whether rightly or wrongly, governments and central banks see crypto as a threat to their monetary sovereignty and their monopoly on surveillance. You can’t have two alpha males in a room. Shit gonna end badly. This means most govts and central banks don’t have an incentive to push for clear crypto regulations. They’d rather kick the can down the road or continue to stifle it in some manner, be it through public warnings about riskiness, backdoor regulations by restricting banks from servicing crypto companies, outright private intimidations, assassinations (not yet) and so on.

But for better or worse, crypto is here to stay, in whatever shape or form, and at $2 trillion, crypto isn’t something regulators can afford to ignore. Crypto at this point is like a purple-coloured mole right between the inner buttcheeks of governments. It requires medical attention, but it’s embarrassing to go to a doctor, drop their pants and show the mole.

Textbook pump and dump

I think I have the power to predict the future. No, I’m not kidding. In this and this post, I had explained how you could become rich by convincing someone with a famous Twitter handle to pump stocks:

I’m not going to go on a sanctimonious rant about pump dump and the need for regulators to take action etc. But it’s scary just how weird the markets have become. Can you imagine some Bollywood celebrities tweeting about stocks to pump them? It wouldn’t take much either, and it’s too damn easy. Indian markets are nowhere as liquid as the US markets. So you can easily pump illiquid stocks with a few tweets and people already doing it.

Not just celebs, anybody with a following on some social media platform can potentially pump stocks. Mark my words, this is just the beginning. We’ll see a lot more of such episodes, and It’s going to fun!

The third way is to find celebrities and convince them to tweet that Elon Musk and Tesla are acquiring PC Jeweller and pivoting the company to Dogecoin mining.

Well, I’m happy to announce that Tipsheet now has an international readership because that’s precisely what happened last week. So, here’s what happened. Some really talented income redistributors (scamsters) created an account in the name of Walmart on GlobeNewswire, one of the largest newswires to distribute press releases. They then released a press release saying Walmart had entered into a partnership with Litecoin. It’s unclear how but they somehow even managed to tweet the announcement from the official Litecoin Twitter handle:

The official handle of the Litecoin Foundation inadvertently shared the announcement:

Litecoin was up almost 30% for a brief period.

The talented income redistributor could’ve bought some Litecoin in advance, pumped the price and sold it off. The genius of this pump was getting all the basics right:

A well-known brand

Tweet from official handles

A thinly traded crypto token

Whoever you people are, I tip my hat, bravo, bravo, well done. Now just try to do this for Yes Bank, and a lot of Indian retail traders will be super happy.

Gyan ka links

Investing & personal finance

A Random List of 50 Things I’ve Learned over a Decade of Blogging Quant Retirement Finance

No FOMO: If you’d bought bitcoin 10 years ago, you wouldn’t be rich today

Momentum is a self-fulfilling prophecy and therein lies its strength

As New Critiques of Sustainable Investing Emerge, Don’t Dump Your ESG Fund

Ek dum Mast likha!!