Top of the agenda

Adventures in cryptoland

I have a problem. Every week I try very hard to not care about this crypto stuff, but I fail miserably. I think I’m addicted to it. So I decided to meditate and find the truth about my crypto addiction. Here’s a profound insight I chanced upon. Stonks are going up, and bonds are going sideways. What the fuck do you even write about them? They’re bloody boring. But peoples, cryptoland is magical and full of action and fun and crazy people. There are shitcoins, DeFi, rekt’ing, HODLING, scamming, pumping and dumping, volcanic mining, coin dogging, and more importantly, our Lord and saviour Elon Musk lives in cryptoland. So, we gotta talk about crytpo. Despair not, cos it’s gonna be fun.

Bitcoin will save the world

Bitcoin has two kinds of people, the traders and the maximalists or true believers. The traders like Bitcoin because of its volatility and don’t care about anything else. But the Bitcoin true believers think that Bitcoin is the answer to our broken central bank dominated global financial system. They’re convinced that short of curing cancer and solving climate change, Buttcoin, sorry, I meant Bitcoin is the answer to everything. They’ll tell you that Bitcoin is a better store of value compared to fiat currencies and that it can open up access to financial services to people in fifth and sixth world countries. They’ll even tell you that with Bitcoin, they can export freedom across the world.

But for a cryptocurrency that aims to replace the dollar, Bitcoin prices are surprisingly beholden to one man’s tweets. Of course, I’m talking about our lord and saviour, Elon Musk. Since I am on the internet and hence clearly jobless, but a jobless expert, I created a beautiful chart of Elon’s tweets vs Bitcoin prices.

Look, saying that Bitcoin or any asset for that matter went up or fell because of X is stupid because markets have millions of participants with unique motivations. To say that they all decided to react to a single piece of news is stupid. Having said that, it’s just ridiculous how much a tweet from Elon with a mention of Bitcoin can move its price.

I am not saying all these price moves are because of Elon, but his tweets clearly seem to matter.

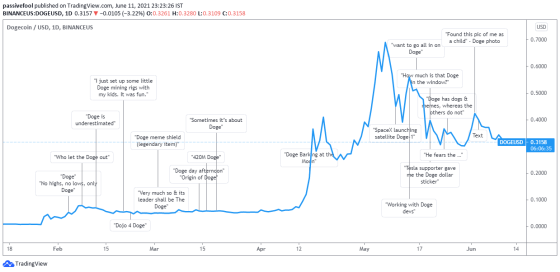

The price moves that his tweets in Dogecoin are even mindboggling , and for context, Doge is up 5300% year to date. Again, I’m not saying it’s all because of Elon, but his tweets clearly seem to affect price.

Say what you will about fiat currencies like the rupee or dollar, they’re tweet proof. I’ve never seen the rupee or the dollar move 10% because some random idiot tweeted something. Even if Himesh Reshammiya tweets tomorrow that he’ll only accept USD for all his singing tomorrow, the rupee won’t move, it’s tweet proof. If the price of an asset moves because someone made a breakup joke, it’s not a currency, it’s funny money.

To ensure I don’t get murdered by the Bitcoin crazies for calling it funny money, I’ll say something nice. I’m not saying Buttcoin, sorry Bitcoin is useless. One day, maybe it will be the global reserve currency, you never know (I said it with a straight face).

The other stupid thing I don’t get is the endless psychoanalysis of why Elon is doing something. People keep coming up with elaborate theories about why Elon is tweeting about Bitcoin. As soon as Elon tweeted about Bitcoin the first time, the entire community embraced him like he was crypto Jesus. But they’ve come to regret it since then. Trying to figure out why Elon tweets rubbish is like trying to find out the reason why a toddler just eats and poops all day. That’s their bloody job!

But since I am on the internet and clearly an expert, let me do my own psychoanalysis. Elon is brilliant, rich and bored. That’s a dangerous combination. I’m not calling him a high functioning sociopath, but he’s like a toddler, and he needs, nay, craves constant attention. That’s all there’s to it. He could care less about crypto because he has better things to do. Ordinary people play games or watch Netflix when bored. Elon, too, likes playing games, but in this case, with the entire crypto community, and he plays them like a fiddle.

This one tweet tells you all you need to know.

Bored geniuses who hate authority, like Elon, don’t have higher motivations. They just want to have fun and cause chaos.

Anybody who tweets stuff like this doesn’t have an smart reason. They just wanna have some funnnn!

It’s that or Elon has secretly bought crypto, and instead of waiting patiently like us normal idiots for prices to go up, he decided to make his own prices. Boss level investing! Elon don’t do fundas and technicals, Elon do memes.

But…

But what’s fascinating to me is Elon’s ability to move prices with just a tweet, not even a video or a press conference. It’s not cryptos, even stocks. In Jan, a random stock with the name signal went up 400%+ when he tweeted “Use Signal”. The stock had nothing to do with messaging app he was referring to in the tweet. In June, shares of Samsung Publishing went up because he tweeted a video they had published. Elon can manifest prices, and that’s a lot of power in the hands of one mortal.

I’m not going to go on a sanctimonious rant about pump dump and the need for regulators to take action etc. But it’s scary just how weird the markets have become. Can you imagine some Bollywood celebrities tweeting about stocks to pump them? It wouldn’t take much either, and it’s too damn easy. Indian markets are nowhere as liquid as the US markets. So you can easily pump illiquid stocks with a few tweets and people already doing it.

Not just celebs, anybody with a following on some social media platform can potentially pump stocks. Mark my words, this is just the beginning. We’ll see a lot more of such episodes, and It’s going to fun!

Looking back, I think we can trace this all back to the GameStop saga. It was the canary in the coalmine. That whole nonsense episode showed us the power of organized masses and how social media platforms can be used to move stonks. Elon saw this and thought, “gee, that looks fun, let me mess with millions of people at the same time.”

If you’re an old school investor and still think that made-up nonsense like valuations, fundamentals etc., matter, you must be smoking some really strong stuff (PS: DM me your dealer’s number). Just like fundamental analysis and technical analysis, there has to be a new approach called tweetstonk analysis. Clearly, it’s more profitable than this whole value investing bullshit.

Worst cult ever!

This month there was a Bitcoin conference in Miami, and boy, oh boy, was it funny. Just watch this video, and you fall laughing out of your chair. This was some next level cringefest.

Money making opportunities

One focus of this blogletter is to help you make money by helping you commit scams and frauds the right way. I’ve written about how to successfully run Ponzi schemes, cattle frauds, crypto frauds, and Ransomware scams. There has never been a better time to be a fraudster or a scamster. I’m very excited to see that lot of talented people in India are now starting crypto Ponzi schemes in India:

“Most of the crypto-related frauds that we have seen over the past year were either reported against those who collected money to invest in crypto and then disappeared, or those who promised high regular returns similar to a multi-level marketing scheme and then ran away with it,” he said. “We have also seen instances where people were investing in a scheme but were not aware that their investment – MD Sharath, superintendent of police— cybercrime division, Bengaluru”

“Singh went ahead and bought 1.25 lakh such $MOMO for 0.2 BNB. But on the day the coin got listed, he realised it had zero value. Later the Telegram and social media groups that offered these coins also stopped working.”

Given that crypto craziness has taken hold in India, we will see some amazing new scams and talented fraudsters getting rewarded for their hard work. I’m excited!

Crypt..uh oh!

For governments and regulators around the world, crypto was like a seemingly benign orange mole on their left bum cheek. It wasn’t painful, so they didn’t bother about it. Instead, they were hoping the mole would go away on its own. But the mole has suddenly become a serious infection, and now everyone is scared.

While some countries have been working to create regulatory frameworks around crypto, India decided to take the creative route of regulating without regulating. I have to admit, it’s a brilliant approach and here’s how it works:

Is crypto banned in India? Yes, it is, but it’s not, but it soon will be, but it’s banned currently but not really.

And now, it looks like they’re trying to clamp down, but again in a weird way.

But

It’s totally weird. The Indian approach to crypto regulation is like a drunk guy trying to ride a horse at night while wearing sunglasses and a saree.

Everything is toilet paper

Let’s say there’s a pandemic, and people are dying. What do you think people should do? The rational thing would be to worry about surviving. But yeah, humans don’t care much about living. As soon as the pandemic hit people started thinking, and their biggest worry was toilet paper. Not surviving, toilet paper!

A large part of humanity collectively thought, “Hmmm, there’s a virus, that’s fine, but how do I wipe my ass?”.

People were so concerned about their asses that they started stocking toilet paper around the world like there was no tomorrow. It was like a scene out of an apocalyptic movie. And all this toilet paper hoarding started causing severe shortages. It got so bad that an armed gang in Hong Kong robbed a local shop and stole 600 rolls.

But over a year into the pandemic, everything in the global economy is now toilet paper. In a previous post, I had written about the global semiconductor or chip shortage and how it’s affecting everyone from electronics manufactures to car manufactures. But, it’s not just chips, there’s a global shortage of everything from shipping containers to underwear. These shortages are causing prices spikes in unexpected places and are a big reason for the recent worries over inflation.

The pandemic simultaneously caused demand and supply shocks. This led to painful readjustments across manufacturing, shipping and supply chains. Manufacturers readjusted their production lines to where the demand was or took supply offline as orders cratered. These supply and demand shocks fed into the global shipping industry. As demand vanished with collapsing exports, charter rates dropped sharply. To ensure freight rates don’t drop sharply, the shipping companies reduced the number of ships and cut costs.

The other important thing is that global supply chains are highly interconnected. Imbalances in one part of a supply chain can have second-order effects elsewhere. But as lockdowns and restrictions eased around the world and economies slowly started coming back online, there was a tremendous upsurge in demand for everything from clothing to ketchup. The post-pandemic shift to online played a big role as people stuck at home started ordering things online like never before.

But the manufacturers and suppliers weren’t ready for the surprising rebound in demand. This is causing all sorts of supply shortages and leading to price spikes of some goods.

Shipping crisis

Shipping is the primary mode of transport for global trade, and 80-90% of all goods are transported on the oceans. But the shipping industry wasn’t ready for a sudden demand spike coming. The first shortage to cause shipping issues and delay in gods was the shortage of shipping containers itself.

Pre-pandemic, at a very simple level, the way shipping used to work is that ships used to transport goods from Asia to the US and Europe, given that Asia is the worlds largest exporter. Then, on the way back, ships picked up goods from America to Asia and other countries.

This meant that the containers were in constant circulation. But as COVID hit Asia, countries starting with China, which is at the heart of the global trade shutdown. So the containers were left lying in the US and European ports as shipping companies took ships offline.

Simultaneously through COVID, container production also took a hit. But as the global economy came back online, there was a tremendous surge in demand for everything from the US. But with a shortage of empty containers in the Asian ports, there were delays in everything from clothes to ketchup.

Exercise equipment shipped by container from Asia to North America more than doubled between September and November, compared with the same period a year earlier, according to analysis by Sea-Intelligence, a Copenhagen-based research company. Shipments of stoves, ranges and cooking equipment nearly doubled in that span. Disinfectants increased by more than 6,800 percent.

What’s making this worse is the fact that shipping companies are cancelling American export orders to export more stuff from China to the US and Europe:

In a bizarre twist of pandemic supply-chain economics, it’s actually more lucrative for carriers to rush empty shipping containers back to countries like China than it is to wait and fill the same containers up with American ag exports. In China, these empty containers can be quickly refilled with U.S. bound products. The basic fact is that shipping carriers make a lot more money transporting stuff to the U.S. than from it. As a result, carriers end up prioritizing the former at the expense of the latter when there’s a logjam

Due to COVID demand shock, ports are highly congested and aren’t operating at full capacity because of a shortage of dockworkers and drivers and also over concerns of fresh outbreaks. This is causing long delays across the world and an insane spike in container freight rates.

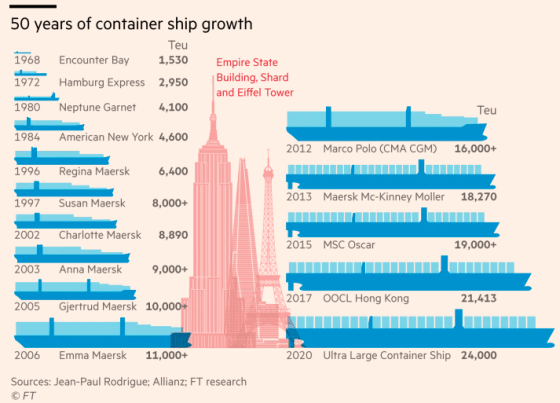

But the seeds of this crisis were a long time in making. Just like large parts of the global economy, even the shipping industry has also become incredibly concentrated. Eight carriers control 81% of shipping. In the race for efficiency, ships have become bigger and bigger and port infrastructure hasn’t kept up.

Nearly all dry and refrigerated shipping container boxes are manufactured in China.

Making ships massive, and combining such massive ships into massive shipping monopolies, is a bad way to run global commerce. We’ve already seen significant problems from big shipping lines helping to transmit financial shocks into trade shocks, such as when Korean shipper Hanjin went under and stranded $14 billion of cargo on the ocean while in bankruptcy.

And so, everything became toilet paper:

There’s a severe global semiconductor shortage. One of the hardest hit has been the automobile industry which will apparently see a hit of over $110 billion. Most automakers, including the likes of Ford and Volkswagen, have cut production and laid-off employees.

A shortage of wooden pallets which are used in packaging has sent their prices soaring by over 400%.

The shortage of pallets is due to the shortage of lumber, the prices of which are up over 280% this year.

With everyone staying at home and ordering junk food, there’s a shortage of ketchup sachets. Prices are up 13% this year,

Given the shipping crisis and also the Suez Canal blockage, there’s a clothing shortage. Retail inventories are at their lowest levels in the recent past. In addition, there have been reports of online retailers burning returned clothing items because it’s more cost-efficient than shipping them.

There’s a severe shortage of labour across the board, from apparel manufacturers in Noida, airports, to restaurants in the US.

The container shortages are causing food shortages in several parts of the world, with food items from grains to vegetables waiting to be shipped stuck at ports everywhere from India to Canada.

The stupid virus unleashed a perfect storm that has laid bare the frailties of our global supply chains. As our doomed planet gets more doomeder and with the incidence of freak weather incidents, diseases outbreaks rising, this won’t be the last time we see such episodes. With an increasing concentration in everything, this won’t be the last time we’ll see such supply chain shocks.

Rabbit hole

Understanding how global shipping works is itself is a rabbit hole that will take up the rest of your life. But it’s terribly fascinating, to say the least. A few interesting sites I came across as I was writing this post.

Hillebrand

Ship Technology

Unctad

Drewry

Ryan Petersen

Loadtsar

ING

Freightwaves

Good reads

1. Living in a World Without Stars

Of course, stock markets are saying something quite different to the people who have had their lives turned upside down in the last year, those millions whose only hope for survival is “quantitative easing,” either via “helicopter money” from the Fed or by unending unemployment checks—perverse pastures of plenty. What they are being told is this: In order for this economy to thrive, we don’t actually need you. We don’t need your labor, because robots and a few college kids will do ever more of the work. To which the unneeded must reply, “Yeah, but what am I supposed to do?” The answer to that question is becoming increasingly obvious: die. Die of Covid, die of poverty, or die of despair, but as much as possible, do it where you won’t be seen.

2. The Dark, Democratizing Power of the Social-Media Stock Market

BitClout, the paper explained, is a social network that runs on blockchain technology, allowing users to “speculate on people and posts with real money.” Every user is given a public price, which is the amount of money that it costs to buy his or her “creator coin.”

3. Winners and Losers: The Global Economy After COVID

Large pharmaceutical companies have reaped lucrative profits with vaccine revenue projected to hit $26 billion by the end of 2021. In contrast, roughly 110,000 restaurants have shut down, and some 200,000 more businesses overall disappeared compared to the usual erosion. Martin Kulldorff, a professor at Harvard Medical School, summarized the impact like this: “Lockdowns have protected the laptop class of young low-risk journalists, scientists, teachers, politicians, and lawyers, while throwing children, the working class, and high-risk older people under the bus.”

4. Peak copper and lithium? The siren song of the peak resource arguments

Peak arguments resurface over and over because they both seem intuitively plausible and play on humanity’s fundamental fear of scarcity. But they are almost always wrong. A decade ago, amidst high oil prices and the Arab Spring, industry analysts were concerned about peak oil production. Today, industry analysts are concerned about peak consumption.

5. Ape Armies and Investor Relations

I’ll end this by saying, while I empathize with financial regulators right now, the markets feel like a referee losing control of a game—where it starts with a few small things no one sees are mishandled, but soon it turns into this:

6. Should investors be worried about US government debt?

The lesson for investors is that there is an important distinction between information and value-relevant information (information you should act on because it adds value to your expected returns). A country’s debt-to-GDP ratio, or its expected growth rate, is information but is not value relevant because in both cases the markets are well aware of the same information and thus have already incorporated it into prices. The result is that the only way you can expect to benefit from that information is to somehow interpret it better than the collective wisdom of investors.

7. The Ultimate Superpower in Investing

In trying to hedge or time your exposure to the next big winners, you will likely miss out on a substantial portion of the gains. Or your emotions will cause you to sell at precisely the worst time (only after a large drawdown). To reap the largest rewards, facing a high degree of pain is unavoidable. Which is why the ultimate superpower in investing is being good at suffering

8. FinTech 3.0 Re-Architecting Financial Market Infrastructure & DeFi

The amount of human & financial capital flocking to DeFi is growing at exponential rates, and it’s an exciting time to be an entrepreneur, builder, investor, and user in the industry. In less than 3-years since the term was initially coined, and four-years since the first product was released, we have $100’s of billions of dollars of capital in the ecosystem, with billions of dollars of value being transferred every day on rails that didn’t exist 5 years ago.

Related read: DeFi for the rest of us

9. Reinventing the Financial System

What makes Maker special from a bank analyst’s perspective is that it’s really quite profitable! The bank is set up as a DAO – a Decentralised Autonomous Organisation – which means it delegates governance decisions to its community. That makes it incredibly transparent. Its performance dashboard is live for all to see; discussions among its users are fully searchable online (imagine that for Board discussions of a bank); and its profits are filed monthly within days of the month end.

10. The Japanese Bubble during the 1980s

Despite this retail investor rush, real estate speculation ended up being more driven by institutions than individuals. Corporations were soon making more on capital gains from their real estate holdings’ appreciation than from operating pro

Playlist

Remains of the week

Tinderization of the Internet. Buy-now-pay-later is hot. Beating inflation. Inside the world of sweepers. App That Monetized Doing Nothing. Understanding PMS. First-Principles Journalism. What scandal is this? Amazon-Apple Book Duopoly. Price of batteries has declined by 97%. Your Uber Ride Is Suddenly Costing a Fortune. Farewell, Millennial Lifestyle Subsidy. A Curse Worse than Cash. Chorecore. California Homelessness. Ugly truth behind credit card rewards. Solar assets are ‘chronically underperforming’. End Of Jack Ma Inc. Virtual reality is the new reality.

If you enjoyed reading this issue, do you want to share this with your friends and show off just how smart you are?

Also, how am I doing with this newsletter? Leave a comment, I’d love to hear your thoughts