I’ve always been scared of my geniusness. But looks like my geniusness might have gotten me into trouble. I’ve uncovered what might be the greatest, scam, con, conspiracy in the history o enlightened humanity.

So, if next week there’s no Tipsheet, that means I’ve been kidnapped or worse yet, sold off to some Eastern European gangs.

Friends, there’s been a global conspiracy, a long con spanning centuries. A tight-knit cabal of global elites has engaged in what is perhaps the longest and most well thought out pump and dump scheme. I’m talking about traditional art. Since homo sapiens stopped scribbling shit on rocks and switched to a canvas, painters, art historians, dealers, art critics, curators, museums, and auction houses have collectively deceived us by convincing us that crap like this is worth hundreds of millions.

Here are 3 of the most famous paintings of all time. Just take a close look at them:

This secretive cabal of elites has convinced the entire world that these paintings are “art”. I say bullshit.

Look at the Monalisa thing. This painting looks like my Aunt when she’s got mildly drunk and watched Radhe on the release day and had to attend a relative’s function the same day while desperately trying not to get angry at the fact that she wasted Rs 400 bucks on that movie ticket and the fact that she wasn’t nearly drunk enough. My 4-year-old nephew would’ve drawn a better portrait of the night sky than this Starry Night thing. Looks like an image of a colonoscopy. Then this kiss thing. What the hell even is this painting? It looks like an advertisement designed in Microsoft Paint for Kalyan Jewellers.

Here are the 4 most expensive paintings ever sold:

Look at the first painting. It looks like Paul Cezanne was trying to become an artist after a heavy night of smoking local maal while simultaneously having a mid-life crisis. The Jackson Pollock is the stupidest thing. It looks like he randomly threw some paint on the canvas – classic art, my ass. My nephew would've done a far better job. The Kooning thing is even ridiculous. If that’s a painting of a woman, then I am Shah Rukh Kahn’s twin brother. The Picasso thing is apparently about a dream. Right, because why not. He couldn’t paint a woman even in his dream, so the title is accurate.

This elite group of people are super smart, and they are genius marketers. Look at the pretentious douchey names they use. Van Gogh and it’s pronounced as “VAN GO” or “VAN HOHH”. When asked why the elites say “GH” is silent. If they’re silent, why the fuck are they in the name? These are psychological tricks they use to embellish the stories behind the paintings and build a mystique around the painters. Would you buy Monalisa if it was painted by a guy named Saravana Kumar?

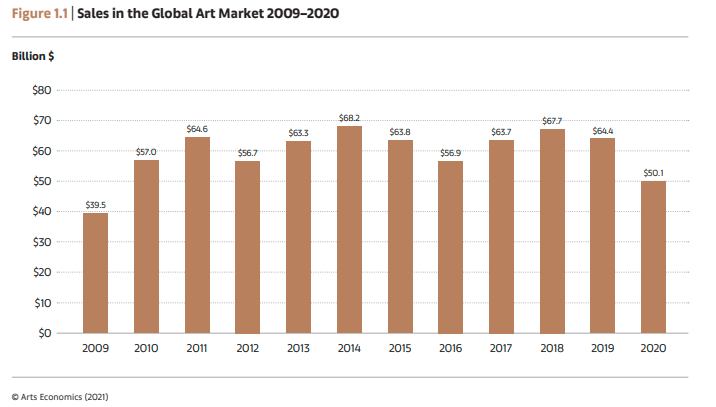

And this elite cabal is quite literally printing billions:

As someone who writes about scams, I can’t help but admire the sheer audacity of this scam.

And then there’s the incredible propaganda machinery. The global elite cabal has recruited all the famous painters, writers, popes, musicians and poets to lie about art. Just try asking a writer or a painter about what makes art valuable, and you’ll hear ridiculous things like:

“Painting is poetry that is seen rather than felt, and poetry is painting that is felt rather than seen.”

― Leonardo da Vinci

“Art is the lie that enables us to realize the truth.”

― Pablo Picasso

“Art enables us to find ourselves and lose ourselves at the same time.”

― Thomas Merton

“Art is the only serious thing in the world. And the artist is the only person who is never serious.”

― Oscar Wilde“The purpose of art is to stop time.”

― Bob Dylan

“The purpose of art is nothing less than the upliftment of the human spirit.”

― Pope John Paul II

But…

But, no longer. A new generation of smart, young and enterprising artists are onto the scam and are changing the rules of the game. They are actually creating profoundly meaningful art. And this new generation of artists doesn’t come with the old school baggage. Unshackled from the cultural orthodoxy, they are reimagining what art is. And they aren’t relying on the old school way of scribbling shit on a canvas either. This new art is totally digital, and they are called non-fungible tokens (NFTs).

NFTs are digital tokens that represent ownership of items like art, music, movies and even physical objects like real estate, sneakers etc. All NFTs reside on a blockchain like Ethereum or Solana. And if you’re new, think of blockchain as a giant public Excel sheet. Whenever someone wants to add a new cell to the Excel sheet, all the people on the sheet have to agree, which makes it extremely secure.

Here’s a comparison of the most expensive and absolutely horrible traditional painting sold vs some of the most expensive NFTs. For $450 million, you got a painting of a weird looking guy asking for a cigarette while holding an emu egg. But the $69 million Beeple (Mike Winkelmann) NFT is an image that contains 5000 images of art created by Mike. A stoned dude asking for a cigarette vs 5000 images within an image.

Now compare this stoner dude to the rock. Look at the intricate design of the rock. If you look closely at the rock for 33 seconds, you can see the universe within it. It’s not an image of rock, it’s a portal to a new dimension, it’s a new experience, it’s the meaning of life, it’s evolution itself. You decide what art is.

The revenge of the cabal

Ever since NFTs exploded onto the scene and starting stealing crappy traditional art’s lunch, the cabal hasn’t kept quiet. They’ve launched a massive disinformation campaign to malign and besmirch the sheer brilliance of NFT art. Here are a few canards and lies they’ve been spreading:

Most NFT art isn’t stored on the Blockchain

When an NFT is minted (created), the token has the ownership record of the art and an URL where the image is stored. So the image is stored elsewhere on some server or Dropbox, not on the blockchain itself. So the traditional art people have been saying that if the image on Dropbox is deleted or if the server has an issue, the art is lost, and all you’ll have is a useless token left. They say that this doesn’t happen with traditional art.

They’ll point you to stories like this one of Tom Kuennen, who lost the image of his NFT:

Last month, Tom Kuennen, a property manager from Ontario, coughed up $500 worth of cryptocurrency for a JPEG of an Elon Musk-themed “Moon Ticket” from DarpaLabs, an anonymous digital art collective. He purchased it through the marketplace OpenSea, one of the largest vendors of so-called non-fungible tokens, or NFTs, in the hopes of reselling it for a profit.

The artwork, which he expected to be on the page, had disappeared entirely. “There was no history of my ever purchasing it, or ever owning it,” he said. “Now there’s nothing. My money’s gone.”Vice

Remember when musician 3LAU sold an NFT album for $11 million on the Gemini-run marketplace NiftyGateway? It might seem like forever ago, but it was at the beginning of March.

And now it’s missing.

To be sure, you can still find a copy of it on NiftyGateway, but the actual NFT asset is no longer discoverable online. It exists only on a centralized provider, a business that could eventually go bust as so many businesses eventually do.Decrypt

I say, so what? The token is on the blockchain, and it’s secure. What if the art file is deleted? You can still stare at the code of your token. The code is the art, not the art in the image. This is a silly canard. Your traditional painting can be stolen too.

NFTs are images that anybody can copy and paste

The other lie the traditional crappy art people have been peddling is that the NFT images are accessible to all and can be copied. This is true, but the images of traditional art are available online too. And you can also buy authentic-looking fakes of traditional art. So, this is another bald-faced false equivalency.

NFT fraud is rampant

They will tell you that scamsters are impersonating famous artists like Banksy and selling NFTs. Sure, it’s true.

They will also tell you that scamsters are creating phishing websites that look exactly like NFT marketplaces like Opensea, designed to steal your wallet details and the crypto and art tokens in them.

The number of suspicious-looking domain registrations with names of NFT stores like ‘rarible’, ‘opensea’, and ‘audius’ have increased nearly 300% in March 2021 when compared to previous months.

So, what? These are growing pains in the journey of digital rocks finally proving once and for all that Monalisa is a funny looking painting of a frustrated aunty. Traditional art suffers from the same problem. Global art fraud, theft, forgeries etc., cause billions in losses.

NFTs are being used for money laundering

The other canard you hear from the shitty Monalisa peddlers is that it’s really easy to launder dirty money with NFTs.

Let’s say Mark has $10 million in illegal profits from his scheme.

Step 1: Buy illiquid JPEG image (with clean money)

Step 2: Buy your own JPEG for $10M (with the illegal money)

Step 3: Claim $10 million in clean profits! Woo Hoo!

Tax evasion through NFTs can also be easily achieved through the same strategies employed using physical art: mint eleven NFT’s, sell one to a friend for $10,000, donate the other ten for a $100,000 loss. Easy-peasy!

Sure, crypto has always been used to launder money. Though numbers are hard to come by, NFTs are probably being used to launder money too:

Money laundering activity is even more concentrated at the deposit address level. In fact, the data above shows that a group of just 1,867 deposit addresses received 75% of all cryptocurrency value sent from illicit addresses in 2020. A smaller group of 270 deposit addresses received 55%. Thinking in terms of raw value rather than percentages, those 270 addresses collectively received $1.3 billion worth of illicit cryptocurrency in 2020, and a smaller group of just 24 received over $500 million worth of illicit cryptocurrency in 2020.

Chainalysis

But, the traditional art market has been used for laundering money for ages:

The tactics used by Green and the others charged in the Picasso scheme remain easy to replicate, at least for now. Green was taking advantage of a regulatory loophole that US and European legislators are working hard to close. Unlike banks, life insurance companies, casinos, currency exchangers, and even precious-metals dealers, auction houses, and art sellers have no obligation to report large cash transactions to a governing authority. In fact, dealers can keep the names of buyers and sellers anonymous. And unlike US businesses that deal in large sums of money, they do not have to file so-called suspicious activity reports with the US Treasury Department if they have doubts about the origins of the money they are being paid.

IMF

The NFT market is just a couple of billion at best as opposed to the $60 billion-plus legal art market. If the traditional art guys really wanted to stop money laundering, they would’ve asked to be regulated. So it’s a bit like the pot calling the kettle purple.

Moreover, freeports have long been known to be hubs of money laundering and storing stolen art and antiques.

Freeports are usually located around shipping ports, or airports.Goods that arrive into freeports from abroad are exempt from tax charges, called tariffs, that are normally paid to the government.

Think of freeports as giant lockers near airports and ports. Whatever is stored in freeports is considered to be in transit, which means no taxation. Also, freeports have very minimal regulations, and they don’t ask for a lot of identification. This has made them the go-to choice to store illegal things and to avoid taxes for a lot of rich people, criminals and cartels.

They’ve also long been known to be used for money laundering purposes:

Of course, there are the outlandish cases of brazen fraud. A recent one involved in the import of a Jean-Michel Basquiat painting, Hannibal, from London to the United States. The customs forms claimed that the artwork inside the crate was worth $100, and therefore was below the value for a duty payment. The painting was actually worth $8 million and was part of an elaborate money laundering scheme set up by a Brazilian embezzler.

Artsy

The Economist estimated that the freeport in Geneva alone holds over $100 billion worth of art:

Wealth piled up in freeports is a headache for insurers. The main building in Geneva holds art worth perhaps $100 billion. The Nahmad art-dealing dynasty alone is said to have dozens of Picassos there. More art is stored in Geneva than insurers are comfortable covering, says Robert Read of Hiscox, an art insurer. Coverage for new items is hard to come by at any price.

The Economist

Rocket

In spite of NFTs not having the art on the blockchain, despite the anti-NFT propaganda by the shitty Monalisa peddlers, NFT volumes have hit new highs:

And the smart people have realized that NFTs, be it pictures of rocks or penguins, are the real art as opposed to horribly painted pictures of dudes and aunties and flower vases and splattered paint stains. They are paying up to own the real art that will surely grow 10-1000000X in the future:

The revolution is afoot.

The fellowship of apes and penguins

Unlike traditional art, which is mostly owned by old white dudes who are 7 years from death, and obnoxious Saudi princes who’ve watched too many rap videos, NFT owners are a true community. They don’t hide in dusky offices with shuttered blinds and pee jars on windowsills. They are building true communities:

Each avatar club is a strange combination of gated online community, stock-shareholding group, and art-appreciation society. When one ape (or cat or pill or alien) is bought for a high price, the perceived value of all ten thousand authentic N.F.T.s in the set rises, the same way a painting fetching a record price at auction might increase the value of an artist’s entire œuvre. When a buyer makes his Twitter avatar an image from a new N.F.T. club, it’s a sign of allegiance, and also a signal to other buyers in the club to follow him on social media. (“I changed my picture to the ape and I got hundreds of Twitter followers the first day,” Swenson said.) The center of most clubs is Discord, the real-time chat app. Bored Ape Yacht Club’s Discord server has more than thirteen thousand members—fans as well as N.F.T. owners—and hosts constant discussion in channels such as #crypto-talk and #sports-bar. The mutual investment, both social and financial, forms a kind of bond among club members within the wider Internet bedlam.

New Yorker

Communities where people can appreciate the value of real art as opposed to ugly looking paintings.

Monalisa, my behind. It’s the ugliest looking painting in the history of humanity. Look at the rock, look at complexity, the intricacy, the hidden layered meaning and the philosophical evocativeness of the art. That’s the real art. Not some frustrated woman who got herself painted after punching her husband while simultaneously having a mild bad hair day.

The ultimate art

Not just visual art. This new generation of genius artists unshackled from the traditional snobbish, douchey and pretentious notions about art is pushing the boundaries. Take the case of Alex Ramírez-Mallis, a film director. Being a creative, he completely reimagined art. Instead of coming up with silly looking paintings, he decided to sell one year’s worth of recorded fart noises as NFTs.

This is art.

Adventures in cryptoland

Poly…going on…

In the last issue, we had had a laugh at the expense of the largest crypto hack ever worth over $600 million. It turns out the hacker returned most of the funds except for $141 million. Here’s where it gets funnier. Apparently, Poly Network paid the hacker almost $500,000 as a bounty. It also even offered him a job as the chief security advisor. Oh boy, I can’t stop myself from laughing:

We are also counting on more experts like Mr. White Hat to be involved in the future development of Poly Network since we believe that we share the vision to build a secure and robust distributed system. Also, to extend our thanks and encourage Mr. White Hat to continue contributing to security advancement in the blockchain world together with Poly Network, we cordially invite Mr. White Hat to be the Chief Security Advisor of Poly Network.

But in spite of that, it seems like the hacker is messing around and is refusing to pay the remaining stolen funds.

But this is a brilliant hiring strategy. If you’re a bank and you want to bolster your cybersecurity, you can hire some whizkid from MIT or Stanford or whatever or find the guy who hacked you previously. I mean, he already knows your weaknesses, and it saves you the trouble of going through absolutely stupid and pointless HR exercises where you ask questions like “where do you see yourself in 5 years”. As if any normal, sane human being knows where he seems himself in 5 minutes, let alone 5 years.

Liquid…ated

Liquid, the Japanese crypto exchange, suffered a hack, and $97 million was stolen. But the interesting part is how the hacker is laundering the money:

This includes $45 million in Ethereum tokens, which are being converted into Ether using decentralised exchanges (DEXs) such as Uniswap and SushiSwap. This enables the hacker to avoid having these assets frozen – as is possible with many Ethereum tokens.

This Ether is now being laundered through Tornado Cash, a smart-contract based mixer used to obscure the blockchain money trail. Close to $20 million of the stolen assets have been sent to Tornado, as of the last update of this article. Exchanges and other crypto service p

This is a boon for aspiring income redistributors (scammers). If you are sitting on some redistributed income (stolen money), you can go by a Van Gogh (GOGH) painting or buy some shitcoins on a decentralized exchange (DEX) like Uniswap or Sushiswap and swap them around enough times to obscure the trail and take out your money.

Indian crypto regulations

Here’s India’s approach to crypto regulation. India is one of the very few countries in the world to have a crystal clear regulatory approach to regulating crypto. India is going to ban crypto. No, it won’t. Yes, it will. It already has, what are you talking about? No, RBI banned it. No, the Supreme court quashed that ban. Arey, no, RBI arm-twisted banks from serving crypto platforms. So, no crypto is banned. Arey, no, no, it is legal but not legal but not illegal but not banned.

But, it looks like something Is in the works. Economic Times had a story that the finance minister might take a decision soon.

An inter-ministerial panel on cryptocurrency, under the secretary (economic affairs), had studies issues around virtual currencies and proposed specific actions in its report.

Good reads

Investing and personal finance

A really interesting three-part (part 1, part 2, part 3) series on what drives fundamentals.

The dance between sticking to your beliefs and abandoning them like a robot, as some people would advise you, is bloody hard.

With momentum being the flavour of the season, here’s an insightful perspective on managing the risks that come with the strategy.

Nobody knows anything, especially the people trying to predict everything.

What is inflation, and how to invest in an inflationary environment?

Is gold a good inflation hedge, or is the narrative nonsense?

There’s no buy and die; things always change.

What you see is not what you get. Have you calculated your post-tax returns?

Brain stuff…thingies

Moneybags and Fintech nonsense

Crypto

Here’s how it feels like to go 20,000 feet into the NFT collector rabbit hole

The suits vs the decentralized money launderers, sorry freedom fighters.

Future of work

The enterprise metaverse is a janky piece of shit

We’re all going to die!

Apocalypse Now: What to take away from the brand new, explosive UN climate report?

The Golden Age of the Electric Vehicle (The first one.)

Tweets

Absolutely Amazing... 😀. After completing my college I will start Money laundering as a service (MasS).😂