It’s been a while since we followed the adventures in cryptoland, so we return to our regularly scheduled programming this week.

Crypto regulating we going to do!

The modern stock market has been over 400 years in the making. As markets evolved, so did the regulations. From a patchwork of securities rules, regulations, guidelines, and customs involving different entities, states and central governments, today, we have dedicated securities regulators. In Amrika, the SEC came into being in 1936. In India, SEBI was created in 1998. They are the financial police.

Given this evolution, the markets have become quite safe. Today, it’s harder than ever to run stock market scams. While we generally think this is a good thing, it’s not. As the markets became safer, millions of honest scamsters and frauds have been unemployed. This is bad for the economy because if these people don’t have jobs, they don’t have money to spend which means the GDP growth will slow down. Facts!

For the record, I don’t like the terms “scamsters” and “frauds”; I prefer the term “income redistributors.” The other issue is that income inequality has been rising across the world. The only reason why it’s not even more grotesque than it is today is because of honest income redistributors (scamsters). By redistributing income (stealing and scamming), these honest and hardworking scamsters have kept a check on income inequality.

But the problem remains that a lot of these hardworking income redistributors are unemployed because of strict financial regulations. But luckily, an entirely new alternate financial system called cryptocurrencies and decentralized finance (DeFi) came into existence in the past 10 odd years.

A few definitions:

Cryptocurrencies are decentralised digital currencies issued using blockchain technology that doesn’t rely on banks or central authorities.

DeFi is an umbrella term for an alternative financial system using blockchain and cryptocurrencies. Just like traditional centralized institutions, like stock exchanges, insurance companies, asset managers, banks etc, there’s a parallel financial system of exchanges, banks, payments solutions, insurance, predictions markets, asset managers and much more. All of this is totally decentralized, powered by smart contracts—lines of code—and not controlled or regulated by any single entity and is powered by cryptocurrencies and crypto tokens.

There are no regulators and regulations in crypto and DeFi. It’s truly the land of the free and home of the scammy. Take the example of Binance, the largest crypto exchange in the world. The average daily volumes are between $20-$50 billion, but it doesn’t have an office, a license, nor is it really regulated by anyone. This is the power of crypto. You can build a business just like that without worrying about utterly stupid things like regulations and laws.

Now, all the income redistributors (scamsters & frauds) who were discriminated against and were shut out of the traditional finance have jobs again. They can run the same old scams in cryptoland without worrying about consequences because cryptoland is unregulated.

They have once again started selflessly fulfilling their god-given duty of stealing from the rich and reducing income inequality.

This is precisely why I think regulating cryptocurrencies is a stupid idea. It will lead to unemployment and increase income inequality.

But governments around the world are filled with geriatric old people who are so technologically savvy that the last new gadget they tried was this 👇

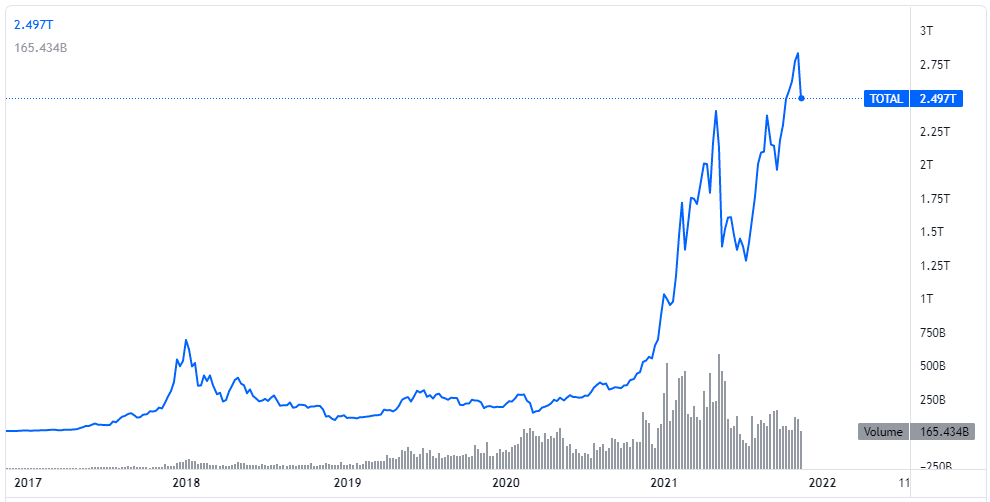

But in an almost Shakespearean tragedy, these old, wrinkly, and senile people who should’ve been in a retirement home 20 years ago run the world. And now, these old farts want to regulate cryptocurrencies and DeFi. Given that crypto was tiny until 5 years ago, these old people didn’t care about it. Moreover, they didn’t really have too much good grey matter left in their brains to focus on two things at a time. But recently, the total crypto market cap hit $3 trillion.

Now, it’s too big for the old anti-crypto infidels to ignore, and they want to regulate it. So far, their approach to regulating crypto has been a bit like a drunk guy trying to do intraday trading using astrology. It’s not working well.

How successful are the old people in trying to regulate crypto, you ask? Let’s look at all the anti-crypto noises the anti-crypto infidels are making across the world.

The biggest noises are coming from Gary Gensler, the chair of SEC (US SEBI) in Amrika. We had spoken about Blockchain Gary and all the anti-freedom and anti-humanity noises he’s been making—if you’re anti-crypto, you’re against freedom and humanity!

All the anti-freedom noises that Blockchain Gary has been making is a sign that shit gonna be bad for crypto. To recap, here are a few anti-freedom things he has said so far:

There’s an old saying: “When I see a bird that walks like a duck and swims like a duck and quacks like a duck, I call that bird a duck.”

The world of crypto finance now has platforms where people can trade tokens and other venues where people can lend tokens. I believe these platforms not only can implicate the securities laws; some platforms also can implicate the commodities laws and the banking laws.

Right now, we just don’t have enough investor protection in crypto. Frankly, at this time, it’s more like the Wild West.

This asset class is rife with fraud, scams, and abuse in certain applications. There’s a great deal of hype and spin about how crypto assets work. In many cases, investors aren’t able to get rigorous, balanced, and complete information.

That little traitor!

In the last few weeks, there were some more anti-freedom developments in Amrika— the home of the largest number of anti-crypto infidels. Last week, Blockchain Gary’s colleague, Commissioner Caroline Crenshaw, published an interesting, albeit ominous piece on DeFi. Here are a few foreboding snippets:

While the underlying technology is sometimes unfamiliar, these digital products and activities have close analogs within the SEC’s jurisdiction.

Market participants who raise capital from investors, or provide regulated services or functions to investors, generally take on legal obligations. In what may be an attempt to disclaim those legal obligations, many DeFi promoters disclose broadly that DeFi is risky and investments may result in losses, without providing the details investors need to assess risk likelihood and severity.

Accordingly, DeFi participants’ current “buyer beware” approach is not an adequate foundation on which to build reimagined financial markets.For example, a variety of DeFi participants, activities, and assets fall within the SEC’s jurisdiction as they involve securities and securities-related conduct.[14] But no DeFi participants within the SEC’s jurisdiction have registered with us, though we continue to encourage participants in DeFi to engage with the staff.

Importantly, if DeFi development teams are not sure whether their project is within the SEC’s jurisdiction, they should reach out to our Strategic Hub for Innovation and Financial Technology (“FinHub”), or our other Offices and Divisions

That being said, for non-compliant projects within our jurisdiction, we do have an effective enforcement mechanism. For example, the SEC recently settled an enforcement action with a purported DeFi platform and its individual promoters.

The core tension here has been that the crypto boies keep shouting that the existing securities regulations are old and incompatible with crypto and that new regulations are needed. But Blockchain Gary and company have been vocal that the existing regulations are more than enough for a vast majority of cryptos and shitcoins, and they should voluntarily come and register themselves.

Highly recommend listening to Blockchain Gary to understand just how anti-freedom he is👇

Next up, Bloomberg, last week reported that the SEC is investing BlockFi’s high-interest rate savings product. BlockFi is a crypto investing and lending platform. One of the products that it offers is called “BlockFi Interest Account (BIA)”—you lend certain cryptos and earn up to 9.5%. For comparison, the highest savings account interest in the US is 0.5% by Goldman Marcus. The SEC is actually quite late to the party. More than 5 states had already clamped down on BlockFi’s interest product.

Apparently, the SEC is investigating whether this lending product is a security and if it should be registered with the SEC. If you remember, I had written about Coinbase’s plans to offer the exact same product and how the SEC shut it down.

Crypto investors on Coinbase could earn 4% by lending certain tokens. Coinbase was of the view that this wasn’t a security and gave the SEC a heads-up that they were launching the product. The SEC told them “ain’t gonna happen, hombre” and threatened Coinbase that they’d sue its decentralized ass if Coinbase launched this product. Coinbase backed out, and it was a dark day from freedom. Goddamn anti-crypto infidels.

Unstable coins?

The other area the anti-freedom infidels are targetting is stablecoins. When traders are in cash waiting for trades, they park their money in a liquid fund or a liquid ETF like LiquidBeEs to ensure that idle cash earns something. The liquid fund of the crypto ecosystem is called a stablecoin. As the name implies, stablecoins are stable in prices compared to other cryptos like Bitcoin, which are pretty volatile.

There are various types of stablecoins, but broadly speaking, stablecoins are pegged to fiat currencies in a 1:1 ratio like the US Dollar or to other cryptos so that the price remains stable. At least theoretically. So every time a stablecoin is minted, the stablecoin issuer goes and buys a dollar or equivalent securities like treasury bills or other cryptos. But in practice, these stablecoin issuers are pretty shady and scammy, and I’m proud of them!

Stablecoins have become popular as the crypto ecosystem has grown. The total market cap of stablecoin today is over $130 billion. It’s a drop in the bucket in the overall crypto ecosystem. But what’s stunning is that all this growth has come in the last couple of years.

Tether (USDT) is the largest stablecoin, with a market cap of $72 billion and daily volumes of $50-$100 billion. If Tether were a bank, it would be the 20th largest bank in the US. It claims that it’s fully backed by fiat currencies or fiat equivalents, but it turns out it was lying out of its ass. It was even sued by the CFTC, and it settled the case by paying a $41 million fine.

Tether has been quite controversial. It’s routinely called the biggest scam in crypto, given the serious doubts over whether it actually holds the reserves that it claims; its complicated company structure spanning multiple offshore jurisdictions; a cast of sketchy characters; and the fact that it’s a well known conduit for money laundering and evading capital controls in countries like China.

Anyways, a working group of infidels comprising of the US Treasury, the Federal Deposit Insurance Corporation (FDIC) and the Office of the Comptroller of the Currency (OCC) released a report on stablecoins. Ominously for stablecoin, the report recommended that stablecoins be regulated just like banks. Today, stablecoins are unregulated. #Freedom

Legislation should address the risks outlined in this report by establishing an appropriate federal prudential framework for payment stablecoin arrangements.29 In particular, with respect to stablecoin issuers, legislation should provide for supervision on a consolidated basis; prudential standards; and, potentially, access to appropriate components of the federal safety net. To accomplish these objectives, legislation should limit stablecoin issuance, and related activities of redemption and maintenance of reserve assets, to entities that are insured depository institutions. The legislation would prohibit other entities from issuing payment stablecoins. Legislation should also ensure that supervisors have authority to implement standards to promote interoperability among stablecoins.

This recommendation is on the lines of the STABLE act proposed by Congresswoman Rashida Tlaib. Here are some highlights by Rohan Grey, who helped craft the bill. Stablecoins are, in essence, narrow banks. They are unregulated, rife with money laundering and systemic risk; I’m not saying they’re useless, mind you.

Now, the old people aren’t going to sit idly. Given that they are old, it will take time for them to find a pen, pick up a pen, and write 2 pages on how to regulate freedom AKA crypto. Then the bureaucrats have to turn those 2 pages into 200 pages of complicated nonsense that even they don’t understand.

Sir Jon Cunliffe, the Deputy Governor for Financial Stability at the Bank of England, recently gave a pretty good speech about stablecoins. He’s old, but despite that, he made sense. He made some excellent points about the system risk posed by stablecoins:

The stablecoins in circulation today are typically backed by a mix of commercial paper, short dated securities and cashfootnote[14]. This backing model is not appropriate for use in systemic payments. If holders were to run from these stablecoins, the assets would not support all redemptions. First, there is a liquidity mismatch between these backing assets and the redemption profile needed to serve as a payment instrument and second stablecoin operators may face difficulties in selling the backing assets, particularly in stressed conditions. These backing structures closely resemble those used by money market funds, where the challenges set out above have materialised in the pastfootnote[15]. In addition, we have also seen that in periods of stress MMF type structures can generate additional financial stability concerns by putting pressure on system-wide liquidityfootnote[16

Laws are coming, and the stablecoin issuers won’t like it. Not even one bit. As soon as the old people are done picking up a pen or learn how to use a keyboard.

We’ll be honest, mother promise!🤗

Last month, Coinbase, one of the largest crypto exchanges and Andreessen Horowitz (a16z)—an investor in Coinbase and other large crypto firms—proposed a two-tier regulatory structure: A separate regulator and a self-regulatory organization (SRO) for digital assets. This is nothing new. It would be similar to AMFI/SEBI in India and FINRA/SEC in the US.

But the underlying tones seems to be: “Just leave us alone, we’ll self-regulate ourselves.” It’s a bit like all thieves forming an organization and promising the police that they won’t steal and will self-regulate themselves. Talk about stupid ideas.

India

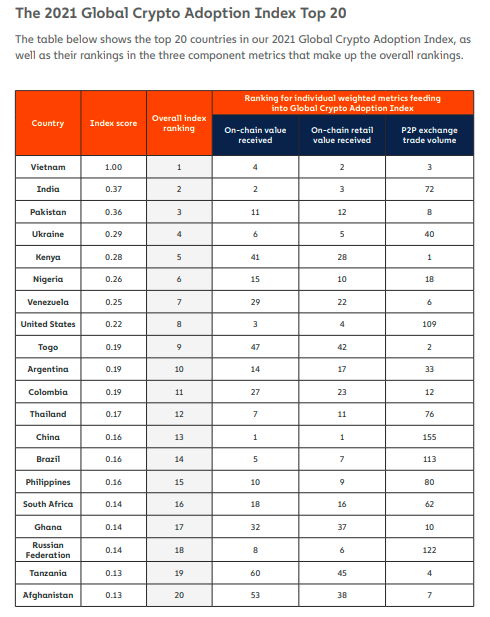

Now, we go to India, the home of Kangana Ranaut. Crypto is getting popular in India, last month, some useless report claimed that with 10 crore crypto investors, India had the highest number of investors in the world. This is nonsense. Even the RBI governor said that the claims were exaggerated, and 70-80% of the accounts had very small balances of Rs 500-2000 ($5-$30)

Maybe a couple of crore users at best?

But at an overall level, crypto is indeed popular—a large number of small investors. Price go up is one hell of a drug to attract degenerates. A recent report by Chainalysis found the same, but please take it with a pinch or three buckets of salt.

So far, India has had one of the clearest crypto regulatory regimes in the world. Crypto is legal but illegal, but not totally illegal, or completely legal in India. Is crypto banned in India? Yes, it is, no it’s not, but it soon will be, but it’s banned currently but not really.

Here’s a little bit of history on India’s incredibly awesome approach to regulating cryptocurrencies. In 2018, the Reserve Bank of India (RBI) had stopped banks from dealing with crypto exchanges and other entities dealing in crypto. The Internet & Mobile Association of India (IAMAI) appealed the ban, and in 2020 the Supreme Court set aside the ban and gave RBI a judicial spanking.

The RBI wasn’t one to back down. The RBI officials went back to the RBI office and saw the “do or die” and “never give up” posters and decided not to give up. They watched The Godfather, got inspired by the mafia and started arm-twisting and threatening the banks and payments processors in private. RBI made them an offer they couldn’t refuse:

The RBI has made informal calls to bank teams seeking information about the extent of business which they do with cryptocurrency traders and exchanges, two private-sector bankers told BloombergQuint on condition of anonymity. The regulator has, in turn, asked banks to rethink this business even though no formal circular asking banks to pull back has been issued.

They threatened to give suparis on bank officials if they dealt with crypto entities. Banks got scared and stopped dealing with crypto exchanges, even though there was no formal ban:

Last week, here’s what RBI Governor Shaktikanta Das had to say:

"When the central bank says we have serious concerns from the point of view of macroeconomic stability and financial stability, there are far deeper issues involved," said Das. "I'm yet to see serious well-informed discussion on these issues in the public domain."

The govt is in a tough spot because coming up with a regulatory framework for regulating freedom, i.e., crypto isn’t as easy as people think. For over a year, the govt had been launching various trial balloons by smartly planting news stories. There have been reports that it was considering banning them, regulating them as commodities and so on to gauge the public reaction.

Now, finally, it looks some sort of regulation is on the horizon. Reports indicate that the govt may table a crypto bill in the winter session of the Parliament. There was also a meeting recently on the same topic. What was interesting was that some ministers were concerned about the recent spike in crypto advertisements.

Rightfully so. Look at these ads. They are utterly stupid. It’s like all the India crypto boies woke up and thought, “Hmm, what’s the best way to piss off the government?” and the best idea they came up with was to call crypto “Safe”, what fucking idiots🤦♀️

It’s like they were begging for a governmental spanking!

Just yesterday, the PM’s office posted a somewhat cryptic yet revealing tweet:

If I were to bet, I’d say the Indian government won’t ban crypto. But it will make the crypto regulation so complex, vague and convoluted, these crypto platforms will not only regret running these stupid ads but will be forced to make nice with the govt by repeatedly kissing some governmental ass.

On the bright side, they will make a lot of lawyers rich, given that the cost of compliance will shoot through the roof. This is good for the economy given that lawyers are notorious overspenders, or so I’ve heard😂

Moreover, the other issue for the govt is that a fair amount of VC investments have flown into crypto. I mean, it’s not a large number relative to other sectors, but still, it’s a pretty penny. If the govt were to ban crypto, it would slightly dent investor confidence. Can it afford to? I think not, but we’ll find out soon. Given given that I’m incredibly wisdomous I’ll obviously be correct.

Don’t ban. Use a hockey bat

At this point, I don’t think most countries will outright ban cryptos. Based on various public statements, reports and policy comments, here’s why I think so:

It’s pretty big at $3 trillion in marketcap, and there’s also a pretty large crypto ecosystem.

A blanket ban isn’t impossible but hard. China just imposed one. Just stopping the banks and payments processors from dealing with these entities and banning P2P transfers will go a long way. But it’ll be complex and costly to enforce the ban because it would require an almost dystopian tracking of digital activity.

The risk of looking like idiots if crypto were to grow bigly, which I think it will. Not this nonsensical, scammy, bullshit version. But some of the cooler things that survive this degenerate excess. The innovation and the spillover effects can be quite valuable.

A blanket ban would also mean that most of the activity will go underground. Today, much of the illegal stuff like money laundering, evading capital controls and illicit financing happens through shady OTC desks. Governments would rather have these activities under their supervision. The chance to extract some taxes is a bonus.

Some countries want to attract VC dollars, tech talent and the prestige of becoming the mecca for crypto boies.

Good old lobbying. Crypto is now mainstream, and in some countries, they have some powerful backers. The most recent example was the brouhaha in the US over the infrastructure bill. The Biden administration had included a provision to tax crypto to pay for the infra bill and had a rather broad definition of crypto “brokers” in the bill. The definition included miners & even service providers, which was odd. The crypto boies rallied, and they managed to get a few senators to propose amendments to clarify this confusion which ultimately failed. But the fact is that they are becoming influential. Not so much in India yet.

So, instead of altogether banning crypto, most governments will take the middle path of making life difficult for the industry. Meaning, occasionally, they’ll hit the crypto boies in the knees with a hockey bat with just enough force to slow them down but not kill them.

Regulating crypto is super duper easy...not

People don’t seem to realize how hard it is to regulate crypto. It’s like Salaman Khan trying to do some actual acting and win an Oscar—It’s unpossible. The first thing to understand is that crypto is not a monolith, it used to be in the early 2010s, but the ecosystem has evolved quite a bit.

Forget the problem of dealing with anonymity, money laundering, taxation, and coordination between different regulators for a second. Forget the systemic risk and monetary policy implications. Forget the fact that govts don’t like digital currencies encroaching on their monetary sovereignty.

Just creating a taxonomy of the various crypto tokens and protocols will be a nightmarish task. Then comes the tricky part of crafting regulations for each of these slices of the crypto ecosystem.

The very first challenge is how do you even define crypto? Is it a currency, security, an investment contract or a commodity?

Today, crypto isn’t just Bitcoin and Ethereum. If it was just simple tokens, you could potentially classify them as securities and regulate them like stocks. This isn’t that complicated. There are also plain vanilla and exotic crypto derivatives.

Then there’s the whole Decentralized Finance (DeFi) ecosystem—an entirely parallel financial system unto itself. A few examples:

Uniswap, PancakeSwap, & Sushiswap are, in essence, decentralized stock exchanges that process billions in volumes.

Lending is another use case that has grown rapidly with $23 billion of outstanding loans.

Prediction markets or betting markets protocol allow you to create a prediction market and invite bets for anything.

There are other protocols for derivatives, insurance, market making, asset management and synthetic assets. All this in just 5 odd years.

Then there are entities called DAOs (decentralized autonomous organizations). These are essentially companies or organizations that live on the blockchain. Unlike traditional companies, these entities are democratic and run by communities with no centralized control.

Some of the popular stablecoins today are larger than the biggest banks, as we discussed above. They are also among the largest holders of govt securities, commercial papers and other money market instruments. This means monetary implications and serious financial stability risks.

Then there are all the legal conflicts between traditional laws and crypto native projects. A lot of these conflicts have to litigated in the ocurts and precedents have to set.

And then there is the fact that private money or things that pretend to be money have a long history, and it has rarely ended well.

And then come all the thorny issues I described above.

All I can say is:

‘Oh wonder!

How many goodly creatures are there here!

How beauteous mankind is! Oh brave new world,

That has such people in’t.’

- William Shakespeare

Things that can make you smart, not as much as me, but still🧠

Damn, this week, there was toooooo many good things. Enjoy not reading all these things.

Investing & markets

What Drives Gold Prices? Related read: Gold, the Golden Constant, COVID-19, 'Massive Passives' and Déjà Vu

Portfolio sensitivity to interest-rate ups and downs: An analysis of the key drivers

How 12th-century Genoese merchants invented the idea of risk

Crypto

Someone Right-Clicked Every NFT In The Heist Of The Century. Related read: My awesome, genius explainer on NFTs.

From Crypto to Christie's: How a metaverse king made his fortune

$76 Billion a Day: How Binance Became the World’s Biggest Crypto Exchange

The Crypto Capital of the World It has to be somewhere. Why not Ukraine?

Coinbase earnings, Socure funding & Magic Internet Money is Bootstrapping Web 3

Tech and VC nonsense

This Lux Capital investor letter was pretty interesting

Odd stuff

Dirty dollars: how tattered US notes became the latest street hustle in Zimbabwe

More Faith, Less Sex: Why Are So Many Unmarried Young Adults Not Having Sex?

Nice post! Curious to know what do you think about the tiger global post? It seems to me like a ponzi scheme. They didn't exit from any of their investments in "delivery" apps stack or the "democratization of investing" stack. How are they making money? Is the profit of the fund is just on paper?

what's the chance of winning of shitload of money if we comment & share