Welcome to The Tipsheet #37, the Financial Times for aspiring scamsters

This week, we learn why you shouldn’t mess with the mafia.

The post might break in your email app, here’s the link to read it on the browser or on your Pocket or Instapaper.

Of late, big tech companies like Facebook, Amazon, Netflix, Microsoft, Apple, and Google are getting as much hate as Donnie Trump. There’s tremendous backlash worldwide against these companies. This has manifested in different ways in different countries. The European Union, which hates the rotten guts of big tech the most, has launched a series of investigations and imposed multibillion-dollar fines.

Countries like India, France, Australia have introduced various forms of digital taxes to make big tech pay in some form or the other. Other countries have or are working on passing regulations around content moderation, legal protections for platforms, etc.

But China, which is home to some of the biggest tech companies outside the US, had largely remained on the sidelines until last year. But the Dragon is waking up and warming up its fiery belly. The only difference is that the motivations of China are different from the other democratic countries.

It all started in November 2020 when Chinese regulators put the brakes on the ~$40 billion IPO of Ant Group, the affiliate of e-commerce giant Alibaba just 48 hours before the listing. The regulators then imposed a record $2.8 billion fine and forced Ant to undergo a painful restructuring. Jack Ma eventually resigned as the chairman of Alibaba.

But things escalated when Didi Chuxing, the Chinese ride-hailing app, raised $4.4 billion by listing its American Depository Shares (ADS) last month. Just 48 hours later, the Cyberspace Administration of China (CAC) announced an investigation into the company. Two days later, the regulator ordered the Didi app, which has nearly 80-90% marketshare in China, to be pulled from the app stores and directed Didi to stop registering new users. Didn’t end there for poor Didi. Yesterday, the regulator intensified the crackdown and ordered 25 others apps offered by Didi to be removed from the app stores, citing illegal data collection.

The Chinese regulators also launched investigations into the truck hailing company Full Truck Alliance (merger of Huochebang and Yunmanman) which listed in the US recently, and Zhipin, an online recruiting app.

So what’s happening?

So here’s the thing. On the face of it, it seems like this is just the Chinese version of a global backlash against big technology companies. But that’s where the seemingness ends.

Like I had mentioned in the previous issue, I’m incredibly wise. And in my wisdom, the problem I have noticed with most analyses about China is that there s a lot of lazy and dumb journalism and analysis. What most China observes fail to appreciate is that China is a managed economy. And much like all the cheap plastic shit that China manufactures, any news item or data point that comes out is also just that, cheap and manufactured shit.

And even more importantly, to think that China just follows an ideology set in a stone tablet enshrined behind the forbidden place is stupidity. Much like the Coronavirus, it’s always mutating. Sure, some of the base ideological strands remain the same, but not everything.

China is not only the world’s factory for cheap toys, but it’s also the world’s factory for bullshit, and it’s damn good at it.

Moreover, to write about China, you need a certain understanding of its history. After all, the Chinese Communist Party (CCP) relies on its own interpretation of history to derive its authoritarian legitimacy. But most of the western experts and us Indians suck at understanding their history and their motivations. Most pundits are just peddling their ideological bullshit to make a living. And the media, well, they care about facts and accuracy as much as Indian movies care about the rules of Physics.

Having said that, you don’t need to quit your job and dedicate your life to reading lengthy tomes on Chinese history. Like I mentioned, I’m goddamn wise, so wise, that it scares me. So in my wisdom, I figured that the best way to understand the motivations behind the Chinese Communist Party’s (CCP) crackdown on Chinese tech companies is to think of the CCP as the mafia.

If you have watched The Godfather, then you’ll remember the iconic opening scene where Bonasera comes to Don Corleone asking for justice. If you don’t remember, just watch the video, and you’ll start seeing China in a whole new light. Don’t read ahead without watching the video!

Don Corleone: I’ve known you many years, but this is the first time you’ve asked for help. I can’t remember the last time you invited me for a cup of coffee. Even though my wife is godmother to your only child. But let’s be frank here. You never wanted my friendship. And you were afraid to be in my debt.

Bonasera: I didn’t want to get into trouble.

Don Corleone: I understand. You found Paradise in America. You made a good living, had police protection and there were courts of law. You didn’t need a friend like me. But now you come to me and say, “Don Corleone, give me justice.” But you don’t ask with respect. You don’t offer friendship.

Bonasera: How much shall I pay you?

Don Corleone: Bonasera, Bonasera. What have I ever done to make you treat me so disrespectfully? If you’d come in friendship, the s**m that ruined your daughter would be suffering this very day. And if an honest man like you should make enemies, they’d be my enemies. And then they would fear you.

Bonasera: Be my friend? Godfather?

Don Corleone: Good. Some day, and that day may never come, I’ll ask a service of you. But until that day accept this justice as a gift on my daughter’s wedding day.

Right? Right? What’d I tell you?

See, the CCP mafia is a simple organization, and the rules of the game are pretty straightforward. The Chinese mafia craves control above all else. You can do whatever you want, wherever or however you want. But, you can never, ever, ever, ever, never have your own agenda or outshine the don. If the don wears Calvin Klein underwear to a party, you wear Rupa; you don’t wear Victoria’s Secret for men and flaunt the elastic. If the don says don’t work with the Americans, you don’t marry them, you send them lemon, chillies, beetle leaves, turmeric, cut a chicken on their doorstep and put a curse on them. And most importantly, you don’t talk shit about the don. It’s that simple.

Like Don Corleone says in the opening, “And if an honest man like you should make enemies, they’d be my enemies. And then they would fear you” and offered protection to Bonasera. It was the same in China. The CCP offered protection to its national champions such as Alibaba, Baidu, and Tencent. It banned or made life difficult for US-based tech companies like Google, Facebook, Dropbox, YouTube, and WhatsApp wanting to compete with the Chinese tech companies.

It promoted homegrown tech companies, gave them money, government contracts, and protected them from enemies. All it asked in return was obedience. No regulations, no nothing. They could do whatever they wanted as long as they obeyed. And things were good.

In 2008 there were 29 Chines companies with $1.1 trillion in revenues on the Fortune Global 500 list by revenues. In 2020, that number was 124, with $8.3 trillion in revenues. In contrast, there were 153 US companies with $7.7 trillion in revenues in 2008 and 121 companies with $9.8 trillion in 2021. If the mafia had allowed the US companies a free pass, there was no bloody way the Chinese companies would’ve grown this big. That’s how the Mafia protects its own.

The Chinese companies grew phenomenally. Of the 50 biggest companies in the Asia Pacific region, half were from China. The scale of these companies is stunning. A few numbers:

The top 150 Chinese companies are worth over $7 trillion.

Between Alibaba, Tencent & Baidu (BAT), they own the largest e-commerce platforms, payments apps, lending platforms, venture capital arms, gaming platforms, messaging apps, search engines, wallets, logistics providers and streaming platforms. Just these 3 companies.

Alipay and WeChat Pay had 55% and 40% market share among payments apps.

Baidu is China’s largest search engine with over 70-80% market share.

Alibaba had over 50% of the Chinese e-commerce marketshare.

Baidu and Tencent Video are among the two largest video streaming services.

Meituan had a market share of over 65% in food delivery. Ele.me is the second-largest and is backed by Alibaba.

Tencent had a 50%+ share of mobile gaming revenues.

Tencent and Alibaba are also prolific investors. Tencent has stakes in over 751 companies whose paper value is worth over $250 billion. Alibaba has stakes in over 528 companies.

80% of Chinese startups worth more than $5 billion have investments from BAT companies.

Of the top 20 apps by time spent, more than 13 are owned by BAT.

Now that the homefront was taken care of, the mafia needed to expand and buy influence. So China started lending to poor countries to create markets for its companies. According to various sources, the Chinese state and state-owned companies have lent over $1.5 trillion to over 150 countries.

On the borrower side, debt is accumulating fast: For the 50 main developing country recipients, we estimate that the average stock of debt owed to China has increased from less than 1% of debtor country GDP in 2005 to more than 15% in 2017. A dozen of these countries owe debt of at least 20% of their nominal GDP to China (Djibouti, Tonga, Maldives, the Republic of the Congo, Kyrgyzstan, Cambodia, Niger, Laos, Zambia, Samoa, Vanuatu, and Mongolia).

Slowly the CCP mafia set up communist party cells inside these private companies to ensure ideological consistency. But over a period of time, as the companies grew, the CCP mafia also wanted these party cells to be involved in decision making. And things seemed to go well. Given that the CCP mafia was in a “war” with America, it gave all the leeway to these companies to grow and outshine their American counterparts.

As time passed, these companies grew to gigantic proportions worth trillions of dollars. And given that they were an essential part of everyday Chinese life, from banking to entertainment, they gathered tons of data every day. Alibaba even had its own social credit system. Some of these companies were still burning cash, and they needed more money. But the listing restrictions in mainland China, Hong Kong, and the lack of domestic capital meant that they couldn’t list.

But the US markets had less stringent restrictions and also the biggest pools of capital. So the Chinese companies slowly started using a creative route called the Variable Interest Entity (VIE) to list in the US. This was because of the difficulty in getting permission to do traditional overseas listings. The mafia didn’t like it but kept quiet.

It used a standard legal shuffle to deploy a variable interest entity, meaning it transfers profits to an offshore corporation with shares that foreign investors can own. Pioneered by the Chinese-language media company Sina in its IPO in 2000, the VIE structure is used by many of China’s internet companies, including Didi. Investors don’t own shares in Alibaba’s profitable e-commerce business. Instead, they hold a piece of a shell company in the Cayman Islands. The earlier Chinese companies went public with as much as 99% of their revenue tied to the VIE, but only 12% of Alibaba’s revenue and 8% of its assets were fixed to the structure.

But as they grew big, they started getting cocky. For example, some of the large e-commerce platforms started strong-arming merchants on their platforms. If you were a merchant on Alibaba’s platforms, you couldn’t sell on Tencent or JD.com’s platforms. Tencent was apparently messing with links of the mini-apps of competitors on its platform. Jack Ma became a showman of sorts and roamed around the world giving speeches projecting “Chinese soft power”. But he took it too far. In a speech in Shanghai last year, he said Chinese banks, which are mostly state-owned, had a “pawnshop mentality”.

Banks today still hold a pawnshop mentality. A pawnshop is about pledges and collaterals, which was an advanced idea in the old days. Without innovations such as pledges and collaterals, there would be no financial institutions today, and the China’s economy would not have developed over the past 40 years to the point where it is now. However, it can go too far if we purely rely on assets and collaterals. As chairman of both the China Entrepreneur Club and the General Association of Zhejiang Entrepreneurs, I have exchanged views with a lot of entrepreneurs. I have found that the pawnshop mentality is a serious problem in China and has affected a lot of entrepreneurs. This becomes extremely serious when entrepreneurs have to pledge all their assets. They are under huge pressure, and what they do becomes distorted. There are also people who borrow like crazy, building up the debt and leverage to a high level.

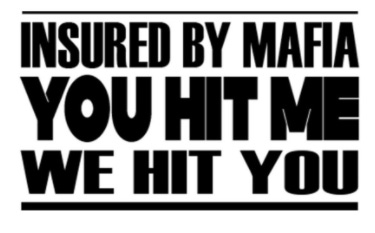

The CCP mafia didn’t like it. Jack forgot the number one rule of the mafia, “You hit me, we hit you”, and hit they did.

They scuttled Ant Group’s IPO, levied a fine, forced Jack Ma to step down and forced a restructuring of Ant. That’s what happens when you mess with the mafia.

This is the moment when the mafia felt that the Chinese tech paisanos were maybe forgetting their place. And like I mentioned in the beginning, the mafia wants control over all things above all else. And when they started to look around, they noticed a bunch of things:

Tech companies had become too big and were acting cocky

These private companies had grown bold and were engaging in anti-monopolistic shenanigans

A few of the founders now had the balls to speak up against the mafia

The number of Chinese tech companies listing in the US was going up

With all the US listings, there was a risk of sensitive Chinese data being leaked

Enemies of the mafia were big supporters and shareholders in these companies

So, like in The Godfather, when Don Corleone convenes a meeting of the 5 families, the Chinese regulators summoned 34 of the biggest tech companies to show them who’s the boss in April 2020. They advised the companies to correct their ways before they had to resort to breaking their knees, or worse yet, put two in the head.

Immediately after the meeting with the mafia, 12 of 34 companies publicly apologized and kissed the don’s ring and hugged him 3 times and sent cookies and Calvin Klein underwear:

On Wednesday, 12 of the 34 tech companies lectured by authorities on Tuesday had issued public statements disclosing their commitment to do business in compliance with laws, after being told to take note of Alibaba’s recent antitrust punishment and to conduct self-inspections in the coming month.

The mafia also started realizing that one of its biggest threats was now outside the home. With Chinese companies now listing in the US, they were concerned that they might leak sensitive data that might endanger their control.

All told, Chinese firms have raised $13bn in America so far this year, and $76bn over the past decade. Around 400 Chinese companies have American listings, roughly twice as many as in 2016. In that period their combined stockmarket value has shot up from less than $400bn to $1.7trn.

There were a series of actions. In June, they passed a data protection bill that was to come into effect in September to ensure sensitive data didn’t leak to foreign enemies. Zhang Yiming, the 38-year co-founder of Bytedance, which owns Tik-Tok, stepped down as the CEO in May. But the mafia really got angry when Didi went ahead and listed in spite of the rumours that the mafia had not approved. This was the moment the mafia decided to step out from the shadows, it decided to send an even stronger message.

Last week, the regulators blocked the merger of two video streaming platforms in which Tencent is a majority shareholder because the combined entities would’ve had 70% marketshare. This was the first major move against Tencent, which had managed to stay on the good side of Beijing. Several companies like Hello and LinDoc are said to have delayed their US IPO plans. Taking aim at the spate of overseas listing, the Cyberspace Administration of China announced yesterday that companies with more than 1 million users wanting to list overseas must undergo a mandatory security review.

I’m 100% sure there are more companies in the mafia crosshairs, and we’ll surely see the mafia retaliate in the coming weeks.

Antitrust

The action against Didi drew many parallels between China and the US, which was also trying to regulate big tech companies. The democrats last month introduced 5 bills with various ant trust proposals to deal with the tech giants. Apart from the bills, The Federal Trade Commission (FTC) and 40 states had filed an antitrust lawsuit against Facebook but lost last month.

But that’s a silly comparison. Here’s the US vs China antitrust approaches

US approach to regulating big tech is a bit like two dorm room girls in a pillow fight, it’s cute

The Chinese approach to regulating big tech, on the other hand, is straight-up gangsta

But here’s where people have to be careful about drawing conclusions. This isn’t just a tech crackdown, this is the Chinese mafia asserting its power and taking back control. It had let the companies grow without much interference because it had to project power globally and compete with America.

But in the name of competition, these companies have reached a stage where the mafia feels threatened. For example, the fact that Alibaba owns full or major stakes in the largest Chinese media properties like the SCMP, several of whose articles I’ve linked so far, Weibo, Yicai among others, was now a problem. A $500 billion e-commerce and finance giant also owning the most read and used news outlets and social media platforms. That’s a little too much control for the mafia’s liking.

While the headlines say that Jack Ma talking shit about China is what caused the trouble, that might not be the full story. It again ties back to the point about the mafia wanting to exert control. Here’s an excerpt from the WSJ:

Some of Ant’s investors and the way their stakes were structured set off alarm bells as regulators dove into the details of the prospectus, the people familiar with the investigation said. One is Boyu Capital, a private-equity firm founded in part by Jiang Zhicheng, the grandson of former Chinese leader Jiang Zemin. Many of Mr. Jiang’s allies have been purged in Mr. Xi’s anticorruption campaign, though he remains a force behind the scenes. Another stakeholder with ties to Mr. Jiang, part of what is called the “Shanghai faction,” is a group led by the son-in-law of Jia Qinglin, a former member of the Politburo Standing Committee, the top echelon of the Communist Party.

These actions are more about consolidating and reasserting power and much less about antitrust.

Adventures in cryptoland – part 4

Inequality is rising around the world. The rich are getting richer, and the poor are getting poorer. While governments around the world pay lip service to the idea of redistributing income, they’re lying. The rich people control the governments, and they aren’t going to let the governments do shit.

And it’s our duty to do something. People who take things without permission from other people are called thieves, which is so dumb. Criminals are not taking things from people without asking. They’re redistributing income from the rich to the poor. If anything, they’re the best solution to income inequality currently. Being a criminal is not just a choice. It’s a patriotic choice.

As aspiring criminals, there’s no better place to fulfil your patriotic duty than in crypto. If you want to become rich and try to rob, let’s say, jewellery from your neighbour, you need many things to go right. You need to wait for your neighbours to go on a vacation, figure out a way to break the lock without causing noise, you need to find a dupatta to cover your face, you need to find a girl to ask for a dupatta first and hope she doesn’t file a sexual harassment complaint, and finally, you need to find a way to sell the repossessed gold (I don’t like the term stealing). This is hard.

But crypto, like I have been writing all along, it’s like taking candy from a baby. The best part is nobody cares about crypto scams.

But here’s a key difference: the sheer number of people getting hoodwinked. With a few outsize exceptions, most crypto scams seem to be getting smaller. That’s the good news. The bad news is that there are more of them, and more people are getting stung. From 2019 to 2020, the number of victims has jumped 48% to an estimated 7.3 million, a figure approaching the official population of Hong Kong. Between the last three months of 2020 and the first three months of 2021, the number of unique scams rose nearly 18%, to 1,335, according to Chainalysis.

Most individual scams are so small that the authorities don’t bat an eye. Regulators around the world tend to prioritize cases involving lots of money, or violations that seem particularly egregious. Cases involving less than $100,000 tend to get a pass

You can keep pulling small scams and not worry about getting caught. I mean, if you use Monero, it’s almost impossible to get caught. To recap some ways to run a crypto scam:

Convince people you'll trade Bitcoin and promise them 5% a month. Name the strategy double quant artificial intelligence premier Padmini, triple recursive machine learning strategy.

If you have tech skills, create a DeFi project called “RISKFREECOIN” and leave a backdoor. Pay some people to hype it up in the media and on crypto Telegram groups that RISKFREECOIN will be the new currency of Tajikistan. Wait for the coin to 🚀steal it, sell it, become Buffett rich.

If you don’t have any skills and don’t want to create anything, find some shitty coin, buy some in advance, hype it and pump and then dump it. It’s that easy

Good reads

I think all investors have to grapple with the idea of “unknown unknowns.” Those who wander from their home markets doubly so.

Now, if you’re investing in the US, Canada, the UK, Australia, or Sweden… I think we can agree there isn’t much country risk in these places that would greatly separate one from another. Most of Western Europe is probably in the same bucket.

But what about Poland? The Warsaw Exchange (in its current form) has only been around since 1991. Is that a step outside the above markets? What about Mexico? What about China?

2. In Defense of Global Stocks

Now that we have thoroughly examined a sampling of global equity returns, we can see that stocks (historically) have provided decent growth to investors across the globe. Of course, the U.S. has been an outlier among this group, but there is a real possibility that it won’t be in the future. If so, as I have demonstrated above, global equities should be able to pick up the slack.

3. Why fragility is the new reality for the stock market

Given the fragile liquidity equilibrium, we expect the market to be prone to moving dramatically from low volatility to high volatility, with the potential for that volatility to then de-escalate quickly once systematic strategies have reduced equity exposure. Figure 4 shows the rolling 24-month volatility of the one-month realized volatility of the S&P 500. The trend is pretty stunning, with the rate of change of volatility consistently two to three times what it was as recently as 10 years ago. It’s this degree of fragility that leads us to distrust situations where the consensus is for prolonged stability.

4. Kitces: The Big Problem With ‘Risk Tolerance’

There is a big difference between a client’s risk capacity and their risk attitude and risk perception. Advisors should keep asking the questions they always have to gauge risk but start asking them in different ways.

But given how much money Robinhood makes from options, its incentives are less around promoting stock ownership and more around promoting options trading. In 1Q21, it made $2.9 revenue per options trade, which compares with $0.4 on an equities trade (and $1.0 on a crypto transaction). Customers had only 2% of their funds invested in options, yet options contributed 14% to total trades and 47% to transaction revenues.4

6. Beware Of ‘Shrinkflation,’ Inflation’s Devious Cousin

If consumers were the rational creatures depicted in classic economic theory, they would notice shrinkflation. They would keep their eyes on the price per Cocoa Puff and not fall for gimmicks in how companies package those Cocoa Puffs. A study by John T. Gourville and Jonathan J. Koehler analyzed data from the market for cereal and other sectors and found that consumers are much more gullible than classic theory predicts. They are more sensitive to changes in price than to changes in quantity. Companies, of course, have known this for years.

7. Tech Monopolies and the Insufficient Necessity of Interoperability

The reason to want more choice isn’t grounded in consumerism. Self-determination isn’t about the superficial desire for a different shade of blue, or about moving your desktop menu icon from the top right corner to the bottom left – it’s about you (and not a corporate exec) having the final say over how you live your life.

Now, all those monopolized industries got to their sorry state by the same route: they bought their small future competitors, merged with their large rivals, and used their market power to crush competitors. Monopolization is the story of investors directing their fortunes to companies who use that capital to buy other companies. It’s the story of success that’s purchased by eliminating alternatives, not by making the best thing that people want the most.

8. A silly guide to the World of Mythical Beasts

On seeing IPO pop, my laughter turns to tears in one seamless take that will do Kamal Haasan proud

Sell-side suddenly turns ultra long-term: “In bull case, we expect profitability before Halley’s comet returns. In bear case, before Yellowstone caldera erupts (so much for terminal value)”

For the few troubled by high revenue multiples, it helps to think in terms of a more modest ‘Multiple of cumulative cash burnt’

Playlist

Remains of the week

Animals are shrinking Blame climate change. Why the password isn’t dead quite yet. Is it time to give up caffeine?. Future of food. Americans are doomed to fail. Neo bank nightmares?. Bad news hidden in the good news on job numbers.

Well in that case at least our Bumbanis and Agdanis are way ahead by getting their boots licked by the leaders. #repect

Makes India look like a new born calf when it comes to revenge